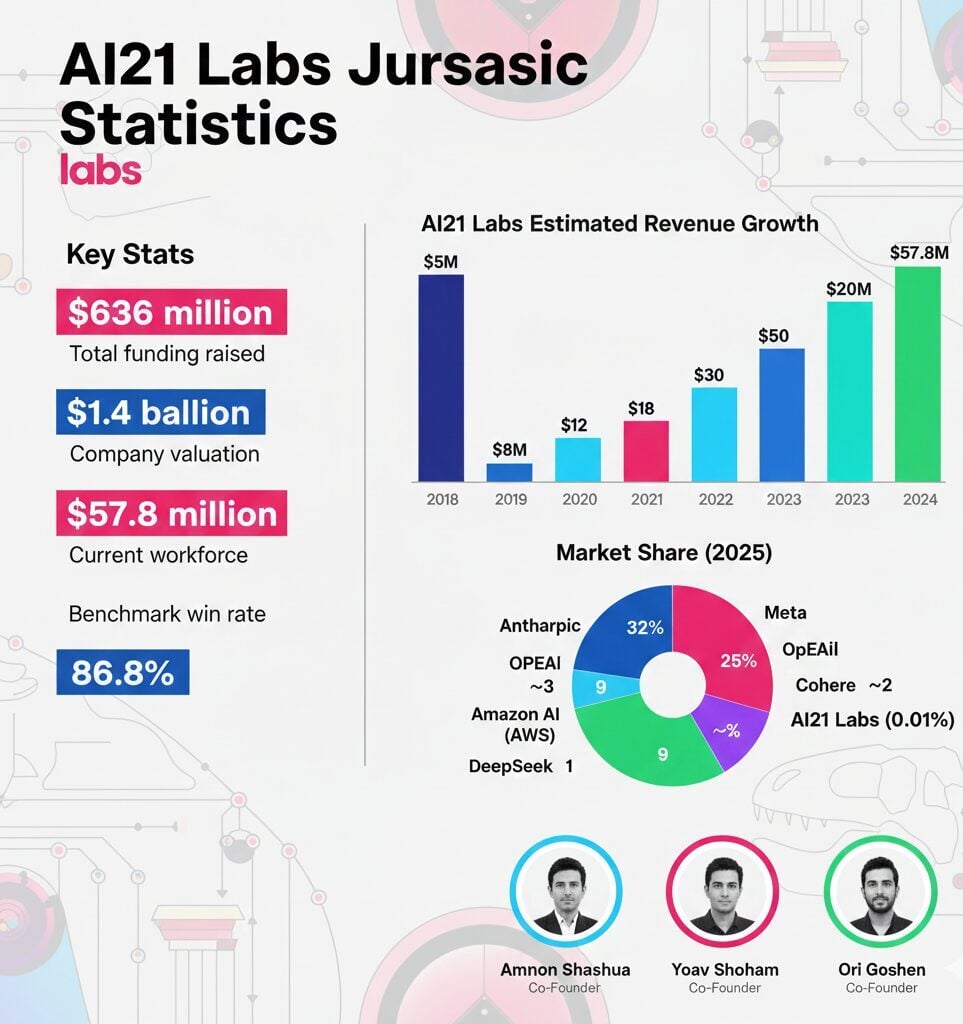

Key Stats

- $636 million — Total funding raised through Series D (May 2025)

- $1.4 billion — Company valuation as of 2023

- $57.8 million — Annual revenue in 2024

- 278 employees — Current workforce size

- 86.8% — Jurassic-2 Ultra HELM benchmark win rate

AI21 Labs is an Israeli artificial intelligence company specializing in natural language processing and large language models. Founded in November 2017, the company develops proprietary LLMs including the Jurassic and Jamba model families.

The Tel Aviv-based startup focuses on enterprise applications, prioritizing reliability and transparency over raw model size. Its technology powers products used by Fortune 500 companies including Capgemini, Wix, and FNAC. AI21 also operates Wordtune, an AI writing assistant with millions of users worldwide.

The company has attracted backing from major technology players including Google, Nvidia, Intel Capital, and Comcast Ventures. Unlike competitors that license foundation models from other providers, AI21 builds its models from scratch to meet enterprise requirements for accuracy and controllability.

AI21 Labs History

AI21 Labs has evolved from a small research-focused startup into a recognized player in enterprise AI. The company pursued a methodical approach to product development, launching consumer applications before expanding into business solutions.

November 2017

Company Founded

AI21 Labs established in Tel Aviv by Amnon Shashua, Yoav Shoham, and Ori Goshen with vision to reimagine reading and writing through AI.

January 2019

Seed Funding Round

Raised $9.5 million in seed funding from early investors to begin model development.

October 2020

Wordtune Launch

Released Wordtune AI writing assistant. Google named it one of its favorite Chrome extensions in 2021.

August 2021

Jurassic-1 Release

Launched Jurassic-1 with 178 billion parameters and vocabulary exceeding 250,000 tokens. Also launched AI21 Studio developer platform.

July 2022

Series B Funding

Raised $64 million led by Ahren with participation from Walden Catalyst, Pitango, and TPY Capital.

March 2023

Jurassic-2 Release

Launched Jurassic-2 featuring 30% faster performance, multilingual support for seven languages, and improved instruction-following capabilities.

August 2023

Series C at $1.4B Valuation

Raised $155 million with participation from Google and Nvidia. Achieved unicorn status with $1.4 billion valuation.

March 2024

Jamba Model Launch

Released Jamba, the first production-grade hybrid Mamba-Transformer model with 256,000-token context window.

May 2025

$300M Series D

Secured $300 million Series D funding from Google and Nvidia, bringing total capital raised to $636 million.

March 2025

Maestro Launch

Introduced Maestro AI orchestration system. Released Jamba 1.6 for private enterprise deployment.

AI21 Labs Co-founders

Three technology veterans with complementary backgrounds founded AI21 Labs. Their combined expertise spans computer science research, successful exits, and enterprise product development.

Amnon Shashua

Chairman & Co-Founder

Computer scientist and serial entrepreneur. Co-founded Mobileye (acquired by Intel for $15.3 billion), OrCam, and OneZero digital bank. Sachs Professor of Computer Science at Hebrew University.

Yoav Shoham

Co-CEO & Co-Founder

Professor Emeritus of Computer Science at Stanford University. Former Principal Scientist at Google. Founded four companies, including Trading Dynamics (sold for $458 million) and Timeful (acquired by Google).

Ori Goshen

Co-CEO & Co-Founder

Serial entrepreneur with 15+ years in technology and product leadership. Founded CrowdX (merged with Cellwize, later sold to Qualcomm) and Fring VoIP service (acquired by Genband).

AI21 Labs Revenue

AI21 Labs generated $57.8 million in revenue during 2024. The company maintains a lean structure with 278 employees, producing revenue per employee of approximately $208,000. This ratio reflects the early-stage nature of the business combined with substantial research and development investments required for foundation model development.

Revenue comes from multiple streams including AI21 Studio API access for developers, enterprise deployments, and Wordtune subscriptions serving millions of users. The company serves Fortune 500 clients across industries requiring reliable AI text generation and analysis capabilities.

AI21 Labs Estimated Revenue Growth

2018

~$5M

2019

~$8M

2020

~$12M

2021

~$18M

2022

~$30M

2023

~$50M

2024

$57.8M

Note: 2018-2023 figures are estimates based on industry reports. 2024 figure is confirmed.

AI21 Labs Market Cap and Valuation

AI21 Labs is a private company and does not have a publicly traded market capitalization. The company achieved unicorn status with a $1.4 billion valuation during its August 2023 Series C funding round. This valuation has remained the most recently disclosed figure as of 2025.

The May 2025 Series D round of $300 million did not publicly disclose a new valuation. Total funding raised now stands at $636 million from investors including Pitango, Walden Catalyst, Samsung NEXT, Intel Capital, Comcast Ventures, Google, and Nvidia.

AI21 Labs Valuation Progression

2019

Seed

2021

Series A

2022

$664M

2023

$1.4B

2025

Undisclosed

Dashed bar indicates valuation not publicly disclosed for Series D round

AI21 Labs Acquisitions

AI21 Labs has not completed any publicly announced acquisitions as of 2025. The company has focused on organic growth and internal development rather than acquiring external companies or technologies. This approach aligns with its strategy of building proprietary foundation models from the ground up.

Instead of acquisition-driven expansion, AI21 has concentrated resources on research and development. The company has developed multiple generations of its Jurassic language models and created the innovative Jamba hybrid architecture combining Mamba state-space models with transformers. This internal focus has produced competitive technical capabilities without relying on purchased intellectual property or talent through acquisitions.

The company’s partnership strategy substitutes for acquisitions in some respects. AI21 has established distribution agreements with major cloud platforms including Amazon Web Services, Google Cloud Platform, Snowflake, and Microsoft Azure. These partnerships extend market reach without requiring ownership stakes. The September 2024 AWS Bedrock integration and July 2024 Snowflake Cortex AI partnership exemplify this approach to growth.

While competitors like Salesforce have grown through numerous acquisitions, AI21 maintains a build-first mentality. The company’s $636 million in funding supports continued internal development of its model infrastructure and enterprise products. Future acquisitions remain possible as the company scales, but current strategy prioritizes organic capability development and strategic partnerships over inorganic growth.

AI21 Jurassic Competitors

AI21 Labs operates in a highly competitive enterprise LLM market dominated by well-funded technology companies. The market reached $6.7 billion in 2024 and is projected to grow to $8.8 billion in 2025 with a compound annual growth rate of 26.1% through 2034. Despite strong technical performance, AI21 holds approximately 0.01% market share as of 2025.

The top seven companies control roughly 79% of the enterprise LLM market. Anthropic leads with 32% share, followed by OpenAI at 25% and Google at 20%. This concentration creates significant barriers for smaller players attempting to gain enterprise adoption.

| Company | Headquarters | Market Share (2025) | Key Models |

|---|---|---|---|

| Anthropic | San Francisco, USA | 32% | Claude 3.5, Claude 4 |

| OpenAI | San Francisco, USA | 25% | GPT-4, GPT-4o |

| Mountain View, USA | 20% | Gemini, PaLM | |

| Meta | Menlo Park, USA | 9% | Llama 3.1, Llama 4 |

| Cohere | Toronto, Canada | ~3% | Command-R, Embed |

| Mistral AI | Paris, France | ~2% | Mistral Large, Mixtral |

| Amazon (AWS) | Seattle, USA | ~2% | Titan, Bedrock |

| DeepSeek | Hangzhou, China | 1% | DeepSeek-V2 |

| AI21 Labs | Tel Aviv, Israel | 0.01% | Jurassic-2, Jamba 1.5 |

| xAI | San Francisco, USA | Emerging | Grok |

Enterprise organizations increasingly adopt portfolio approaches, with 37% using five or more models in production environments. This multi-model reality creates opportunities for specialized providers like AI21 to serve specific use cases requiring high reliability, transparency, and data governance. The company differentiates through its Foundation Model Transparency Index score of 75, significantly exceeding the industry mean of 58.

FAQs

What is AI21 Labs Jurassic?

AI21 Labs Jurassic is a family of large language models developed by Israeli AI company AI21 Labs. Jurassic-2 Ultra achieved 86.8% HELM benchmark win rate and supports seven languages for enterprise text generation applications.

How much is AI21 Labs worth?

AI21 Labs achieved a $1.4 billion valuation during its August 2023 Series C funding round. The company has raised $636 million total through May 2025, though its Series D valuation was not publicly disclosed.

Who founded AI21 Labs?

AI21 Labs was founded in November 2017 by Amnon Shashua (Mobileye co-founder), Yoav Shoham (Stanford professor, ex-Google), and Ori Goshen (serial entrepreneur). The company is headquartered in Tel Aviv, Israel.

What is the difference between Jurassic and Jamba models?

Jurassic models use traditional transformer architecture, while Jamba combines Mamba state-space models with transformers. Jamba offers 256,000-token context windows and 2.5x faster inference on long contexts compared to similar-sized competitors.

Who are AI21 Labs main competitors?

AI21 Labs competes with Anthropic (32% market share), OpenAI (25%), Google (20%), Meta Llama (9%), and Cohere in the enterprise LLM market. The company holds approximately 0.01% market share as of 2025.