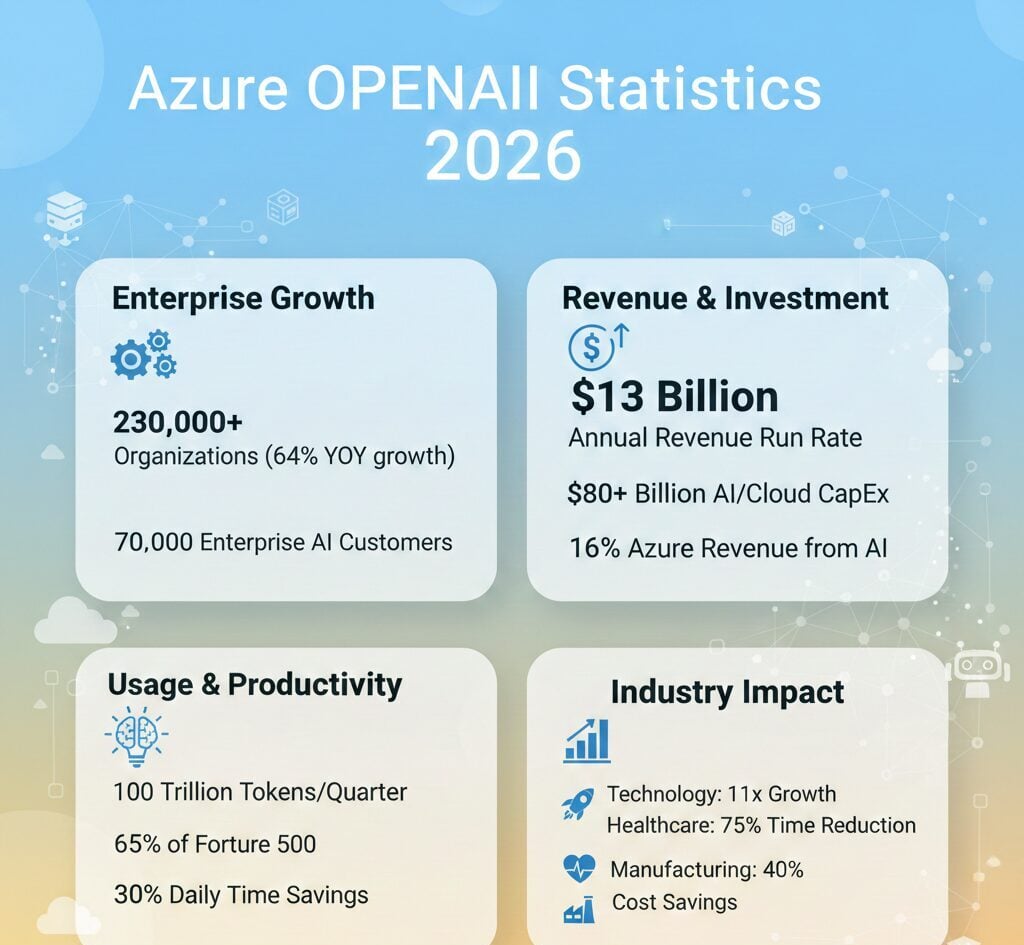

Azure OpenAI Service reached 230,000 organizational deployments as of Q3 2025, marking a 64% year-over-year growth rate that positions Microsoft’s enterprise AI platform as the dominant commercial provider of advanced language models. The service generated $13 billion in annual revenue run rate while processing over 100 trillion tokens per quarter, with 65% of Fortune 500 companies now using the platform for production-scale AI implementations.

This analysis examines verified adoption metrics, revenue performance, and industry deployment patterns that define Azure OpenAI’s market position.

Azure OpenAI Key Statistics

- Azure OpenAI Service serves 230,000 organizations globally as of Q3 2025, with 70,000 enterprises using Azure AI services

- Microsoft generated $13 billion in AI annual revenue run rate in 2025, up from $4.7 billion in 2024

- AI services contributed 16% to Azure revenue growth in Q3 2025, increasing from 9% in Q4 2024

- OpenAI spent $12.43 billion on inference computing through Azure between 2024 and Q3 2025

- Token processing volumes reached 100 trillion per quarter in Q3 2025, representing a fivefold increase from 2024

Azure OpenAI Enterprise Customer Growth

Azure AI customers increased from 53,000 in Q1 2024 to 70,000 by Q3 2025, maintaining a consistent 64% year-over-year growth rate across two consecutive quarters. The platform added 27,000 new customers in the most recent twelve-month period.

Microsoft’s exclusive commercial distribution agreement with OpenAI extends through 2030, creating significant barriers for competitors seeking to offer equivalent enterprise capabilities. The partnership secured Azure’s position as the sole commercial API provider for GPT-4 and subsequent OpenAI models in enterprise environments.

Approximately one-third of current Azure AI customers joined within the past twelve months, indicating sustained market momentum beyond initial early-adopter phases. The growth trajectory suggests enterprises are moving from experimental deployments to production-scale implementations across operational workflows.

Fortune 500 Azure OpenAI Deployment Rates

Fortune 500 adoption accelerated from 50% in Q1 2024 to 65% by Q4 2024, where it stabilized through Q2 2025. Microsoft reported that 85% of Fortune 500 companies utilized some form of Microsoft AI technology as of late 2024.

Microsoft 365 Copilot deployment among Fortune 500 enterprises reached 90% by Q2 2025, up from 70% in Q4 2024. The progression indicates enterprises transitioned from pilot programs to organization-wide AI tool implementations.

Notable enterprise customers include Ally Financial, Coca-Cola, Rockwell Automation, and Walmart. Research and development departments showed particularly strong adoption, with 68% of Fortune 100 companies using OpenAI models in R&D functions as of Q2 2025.

Azure OpenAI Revenue Performance

AI services increased their contribution to Azure revenue from 7% in early 2024 to 16% by Q3 2025. Microsoft’s Intelligent Cloud segment generated $106.3 billion in fiscal year revenue, with AI-driven growth becoming a central component of cloud strategy.

Microsoft committed over $80 billion for fiscal year 2025 cloud and AI infrastructure development, representing a 75% increase from the $55.7 billion allocated in FY2024. The company invested $19 billion in Q4 2024 alone for data center and AI infrastructure expansion.

OpenAI operates under a 20% revenue share agreement with Microsoft, with payments increasing from $493.8 million in 2024 to $865.8 million through the first three quarters of 2025. The financial relationship demonstrates the scale of computational resources powering enterprise AI deployments.

| Financial Metric | 2024 | 2025 |

|---|---|---|

| Azure Revenue Growth (YoY) | 30% | 33% |

| AI Contribution to Azure Revenue | 9% | 16% |

| Microsoft AI Annual Revenue Run Rate | $4.7 Billion | $13 Billion |

| Microsoft CapEx (AI/Cloud) | $55.7 Billion | $80+ Billion |

Enterprise Usage and Productivity Metrics

Weekly enterprise messages through ChatGPT Enterprise grew approximately 8x year-over-year, with average workers sending 30% more messages compared to the previous year. ChatGPT Enterprise seats increased ninefold during the 2024-2025 period.

Organizations achieved $3.70 return for every dollar invested in generative AI technologies, according to IDC research commissioned by Microsoft. Employees reported saving between 16 and 30 minutes daily on routine tasks through AI-powered automation.

Token processing volumes demonstrate the operational scale of enterprise deployments. Azure OpenAI processed 20 trillion tokens per quarter in 2024, escalating to over 100 trillion tokens per quarter by Q3 2025. The fivefold increase reflects both growing adoption and expanded use cases across organizations.

Azure OpenAI Industry Sector Adoption

The technology sector achieved 11x growth in median enterprise AI usage during the 2024-2025 period, making it the fastest-growing vertical for Azure OpenAI implementations. Azure OpenAI applications in the technology sector doubled year-over-year.

Healthcare deployments processed over 150 million documents in three weeks for oncology data extraction projects, demonstrating the platform’s capability for large-scale document analysis. Healthcare implementations reduced processing time by 75% compared to manual methods.

Manufacturing operations reported 40% cost savings and 30% increases in production efficiency through Azure OpenAI integrations. Financial services implementations achieved 40% reductions in fraud detection false positives, while professional services organizations improved clinician retention by 58% through AI-assisted workflows.

Retail sector deployments across 35,000 Azure customers generated 15% sales increases through AI-powered chatbot implementations. The results demonstrate measurable business impact across diverse operational contexts.

| Industry Sector | Key Outcome | Performance Metric |

|---|---|---|

| Technology | Enterprise AI Usage | 11x YoY Growth |

| Healthcare | Processing Time | 75% Reduction |

| Manufacturing | Operations Cost | 40% Savings |

| Financial Services | Fraud Detection | 40% Reduction |

| Professional Services | Clinician Retention | 58% Improvement |

| Retail | Sales Performance | 15% Increase |

Global Market Position and Infrastructure

Azure holds 24% of the global cloud computing market as of Q1 2024, positioning it as the second-largest provider behind AWS at 31%. The platform operates across more than 60 global regions in 140 countries, with 722 million Azure Active Directory users.

Microsoft’s cumulative investment exceeding $13 billion in OpenAI secured exclusive API distribution rights for enterprise customers through 2030. The investment represents 49% equity stake in OpenAI, creating structural advantages in the enterprise AI market.

Azure’s marketplace offers over 5,379 AI and machine learning-enabled services, providing enterprises with pre-built integrations and specialized tools. The extensive service catalog differentiates Azure from competitors in enterprise AI deployment scenarios.

Future Growth Projections

IDC projects global AI spending will reach $632 billion by 2028, with Microsoft positioned to capture substantial market share through Azure OpenAI Service. Microsoft’s Q1 FY2026 guidance projects Azure revenue growth of approximately 37% year-over-year in Q2.

OpenAI’s revenue projections increased to $125 billion by 2029, up from earlier estimates. The revised forecasts reflect accelerating enterprise adoption and expanding use cases across industries. OpenAI committed to a $250 billion new Azure infrastructure agreement to support projected growth.

Enterprise survey data indicates 92% of organizations plan to increase AI investments through 2028, suggesting sustained demand growth for enterprise AI platforms. The investment intentions span both new deployments and expansion of existing implementations.

FAQ

How many organizations use Azure OpenAI Service?

Over 230,000 organizations globally use Azure OpenAI Service as of Q3 2025, with 70,000 enterprises actively using broader Azure AI services across the platform.

What percentage of Fortune 500 companies use Azure OpenAI?

Approximately 65% of Fortune 500 companies utilize Azure OpenAI Service as of 2025, with 85% employing some form of Microsoft AI technology in their operations.

How much revenue does AI generate for Azure?

AI services contributed 16% to Azure’s revenue growth by Q3 2025, increasing from 9% in Q4 2024, with Microsoft’s AI annual revenue run rate reaching $13 billion.

What is Microsoft’s total investment in OpenAI?

Microsoft invested over $13 billion in OpenAI, securing a 49% equity stake and exclusive enterprise distribution rights for OpenAI models through Azure until at least 2030.

How fast is Azure OpenAI adoption growing?

Azure OpenAI Service adoption grew 64% year-over-year from 2024 to 2025, with ChatGPT Enterprise seats increasing ninefold and token processing volumes growing fivefold during the same period.