Key Stats

Binance operates as the world’s largest cryptocurrency exchange by trading volume. Founded in 2017, the platform transformed the digital asset trading landscape through rapid expansion and technological innovation. The exchange serves millions of users across 180 countries.

The platform provides spot trading, futures contracts, margin trading, and staking services. Binance supports over 350 cryptocurrencies and numerous trading pairs. Users access the exchange through web browsers, mobile applications, and desktop software.

Beyond core exchange services, Binance developed an extensive ecosystem. The company launched payment solutions supporting 1,000 payment methods and 125 fiat currencies. It operates blockchain infrastructure, educational initiatives, and venture capital operations through Binance Labs.

Binance History

Binance Co-founders

Binance Revenue

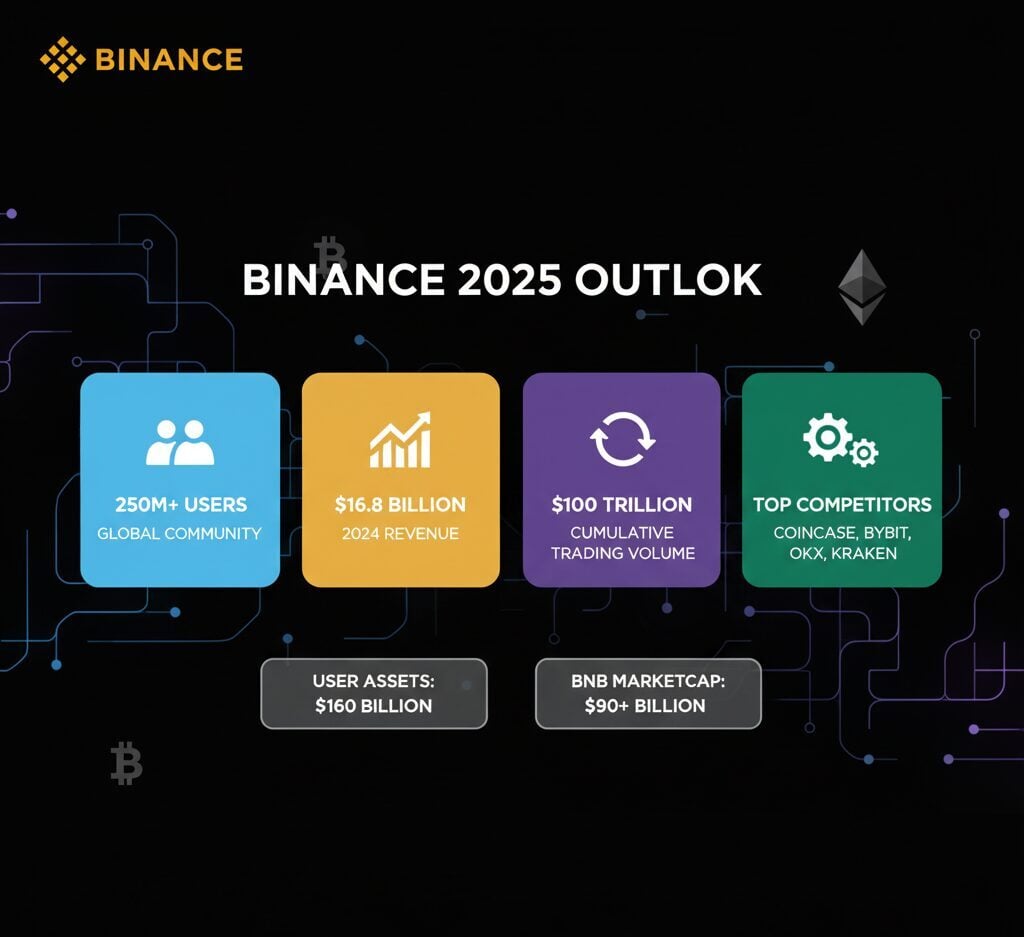

Binance generated $16.8 billion in revenue during 2024, representing a 40% year-over-year increase. The company derives approximately 90% of its revenue from trading fees charged on spot and derivatives transactions.

Binance Marketcap

Binance operates as a private company without publicly traded equity. The BNB token, native to the Binance ecosystem, maintains a market capitalization exceeding $90 billion as of 2024.

Binance Acquisitions

Binance pursued strategic acquisitions to expand its ecosystem and strengthen market position. The company’s acquisition strategy focused on technology platforms, data providers, and regional exchanges that complemented its core trading operations.

Trust Wallet became Binance’s first acquisition in July 2018. The mobile cryptocurrency wallet supported Ethereum and over 20,000 ERC20 tokens at the time of purchase. Binance paid in cash, company stock, and BNB tokens while allowing Trust Wallet to maintain operational independence. The acquisition provided Binance users with a decentralized wallet option and served as the default wallet for Binance’s decentralized exchange.

The company acquired DappReview, a Beijing-based analytics platform for decentralized applications. This purchase enhanced Binance’s ability to track and evaluate blockchain projects across multiple networks. The platform provided data-driven insights into the performance and adoption of decentralized applications.

In 2019, Binance acquired WazirX, India’s leading cryptocurrency exchange. The purchase established Binance’s presence in one of the world’s largest potential cryptocurrency markets. WazirX continued operating as a separate entity while benefiting from exchange infrastructure support and technological resources from Binance.

CoinMarketCap represented Binance’s largest acquisition at an estimated $400 million in April 2020. The cryptocurrency data aggregator attracted 207 million visitors during the six months preceding the acquisition. The purchase drew concern from competitors and industry observers about potential conflicts of interest, as Binance gained control over the industry’s primary price discovery and ranking platform.

Binance also acquired JEX, a Seychelles-based derivatives trading platform. The purchase expanded Binance’s offerings in cryptocurrency futures and options trading. Throughout these acquisitions, Binance maintained a strategy of allowing purchased companies to operate with significant autonomy while providing resources for growth and development. The company’s $1 billion acquisition fund, announced in 2018, supported plans for 10-20 investments annually alongside three to four strategic acquisitions.

Binance Competitors

Binance faces competition from established exchanges across spot and derivatives markets. Competitors vary in geographic focus, regulatory compliance, and product offerings. Different platforms target distinct customer segments from retail traders to institutional investors.

| Competitor | Founded | Headquarters | Daily Trading Volume |

|---|---|---|---|

| Coinbase | 2012 | United States | $3.4 billion |

| Bybit | 2018 | Dubai | $3.5 billion |

| OKX | 2017 | Seychelles | $3.5 billion |

| Kraken | 2011 | United States | $2.8 billion |

| KuCoin | 2017 | Seychelles | $2.1 billion |

| Gate.io | 2013 | Cayman Islands | $1.9 billion |

| Crypto.com | 2016 | Singapore | $1.8 billion |

| Bitget | 2018 | Seychelles | $1.6 billion |

| HTX (Huobi) | 2013 | Seychelles | $1.4 billion |

| MEXC | 2018 | Seychelles | $1.2 billion |

FAQs

Who founded Binance?

Changpeng Zhao and Yi He co-founded Binance in 2017. Zhao previously worked at Bloomberg and OKCoin, while Yi He co-founded OKCoin and led marketing operations.

Where is Binance headquartered?

Binance operates without a fixed headquarters. The company maintains offices in Dubai and Paris while serving users in 180 countries through a decentralized operational structure.

What is BNB token?

BNB serves as the native cryptocurrency of the BNB Chain blockchain. Users pay reduced trading fees with BNB on Binance. The token supports smart contracts and decentralized applications.

How does Binance generate revenue?

Binance earns approximately 90% of revenue from trading fees on spot and derivatives transactions. Additional income streams include listing fees, margin trading interest, and staking services.

Is Binance available in the United States?

U.S. residents cannot access the main Binance platform. Binance.US operates as a separate entity following U.S. regulations, offering reduced features and fewer cryptocurrencies than the international platform.