Key Stats

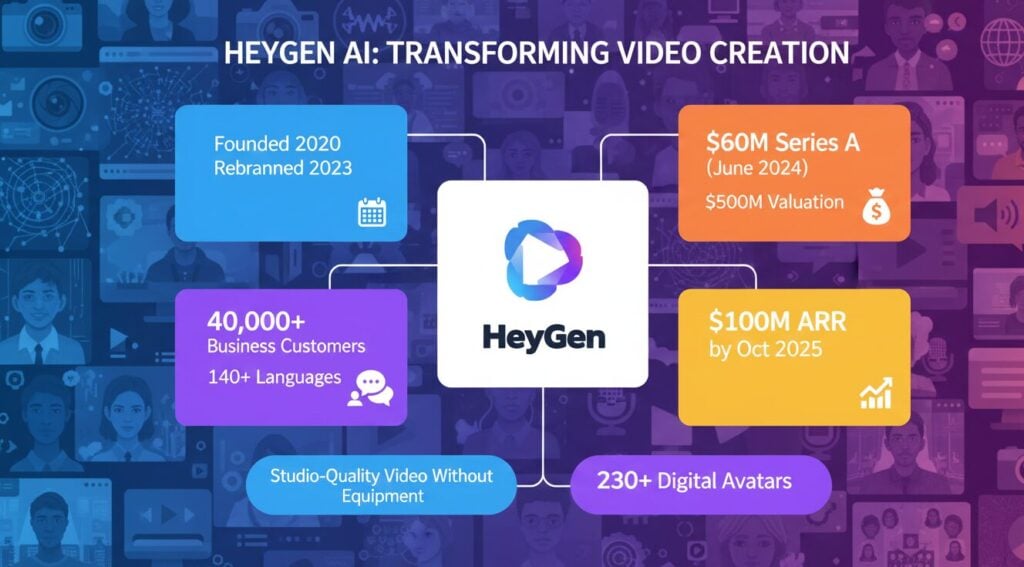

HeyGen AI operates as a video generation platform that transformed how businesses create content. The company enables users to produce studio-quality videos without traditional filming equipment. Founded in 2020 by Joshua Xu and Wayne Liang, the platform originally launched as Surreal before rebranding to HeyGen in 2023. The company raised $60 million in Series A funding at a $500 million valuation in June 2024. With over 40,000 paying business customers and support for more than 140 languages, HeyGen serves markets ranging from small businesses to Fortune 500 companies.

HeyGen AI History

HeyGen AI Co-founders

Joshua Xu holds a Master’s degree in Computer Science from Carnegie Mellon University and previously worked as a lead engineer at Snapchat, where he developed innovations in ads ranking, machine learning, and computational photography. He leads HeyGen’s mission to make visual storytelling accessible through AI video technology.

Wayne Liang co-founded HeyGen alongside Joshua Xu in 2020. Both founders attended Tongji University in Shanghai before pursuing master’s degrees at Carnegie Mellon University. Liang serves as Chief Innovation Officer, driving the company’s product development and technological advancement.

HeyGen AI Revenue

HeyGen AI demonstrated explosive revenue growth from its 2022 launch through 2025. The company reached $1 million in annual recurring revenue within 178 days of launching its first product. By May 2024, revenue had surged to approximately $22 million annualized.

The growth trajectory accelerated further with the company reporting $35 million in ARR by June 2024. By October 2025, HeyGen AI crossed the $100 million ARR milestone, representing a 1,024% year-over-year increase from 2023 levels.

HeyGen AI Marketcap

HeyGen AI achieved a $500 million valuation following its Series A funding round in June 2024. The company attracted investment from prominent venture capital firms including Benchmark, which led the round, along with participation from Thrive Capital, BOND, and Conviction.

The valuation reflects strong investor confidence in the synthetic video market and HeyGen AI’s execution capabilities. The company’s path to this valuation included early backing from Sequoia China and ZhenFund before transitioning to US-based investors. Sarah Guo’s Conviction firm played a pivotal role, replacing Chinese investors on the board in 2023. The rapid valuation growth mirrors trends seen in other technology companies that achieved product-market fit quickly.

HeyGen AI Acquisitions

HeyGen AI has not completed any acquisitions since its founding in 2020. The company focused entirely on organic growth and internal product development rather than pursuing inorganic expansion through acquisitions. This strategy allowed HeyGen AI to maintain operational agility while scaling rapidly.

Unlike many competitors in the AI video space who pursued acquisition-driven growth, HeyGen AI built its technology stack from the ground up. The company invested heavily in developing proprietary algorithms for avatar generation, lip-sync technology, and multilingual translation capabilities. This approach gave HeyGen AI complete control over its product roadmap and technology infrastructure.

The decision to avoid acquisitions aligns with the company’s lean operational model. With approximately 157 employees generating $100 million in annual recurring revenue, HeyGen AI achieved remarkable efficiency. The company demonstrated that focused internal development can compete effectively against larger players with more complex organizational structures resulting from multiple acquisitions.

Industry context shows a different pattern among HeyGen AI competitors. Canva acquired Leonardo AI in July 2024 for AI image creation capabilities. Reddit purchased Memorable AI in August 2024 to enhance advertising technology. Panopto acquired Elai in October 2024 to add text-to-video features. These moves by competitors reinforced HeyGen AI’s position as an independent player with differentiated technology. The company’s Series A funding of $60 million provided sufficient capital to continue organic growth without requiring acquisitions for market expansion.

The company’s focus remained on iterating its core platform, maintaining a weekly release schedule since launch. This development velocity would likely have slowed had HeyGen AI pursued integration of acquired companies. The acquisition approach taken by semiconductor companies contrasts sharply with HeyGen AI’s strategy, where rapid feature deployment took priority over consolidating market share through purchases.

HeyGen AI Competitors

HeyGen AI operates in a competitive landscape with established players and emerging startups. The AI video generation market includes companies targeting various segments from enterprise training to social media content creation. Competition intensified as traditional video editing platforms added AI features and new startups entered the space.

| Competitor | Key Differentiator | Primary Market |

|---|---|---|

| Synthesia | Expressive avatars, enterprise collaboration features | Corporate training and communications |

| D-ID | Photo animation, creative studio for basic avatars | Marketing and social content |

| Colossyan | Interactive features, multilingual workplace learning | Corporate training and education |

| Elai.io | URL-to-video conversion, custom studio avatars | Marketing and sales enablement |

| DeepBrain AI | Broadcast-quality output, social media templates | News media and professional video |

| Pictory | Text-to-video with automated editing | Content creators and marketers |

| Rephrase.ai | Personalized video campaigns at scale | Sales and customer engagement |

| Hour One | Synthetic video creation platform | Enterprise communications |

| Argil AI | Content creator focus, cost-effective pricing | Individual creators and small teams |

| Veed.io | Comprehensive video editor with AI tools | Online video editing and subtitling |

Market dynamics show consolidation trends as larger platforms acquire AI video capabilities. The competitive positioning of each player depends on avatar quality, language support, rendering speed, and integration capabilities. HeyGen AI differentiated through superior lip-sync accuracy and natural avatar movements, addressing the uncanny valley effect that plagued earlier synthetic video technology.

Enterprise customers evaluate platforms based on security certifications, collaboration features, and scalability. Synthesia targets this segment with SOC 2 compliance and advanced team management. HeyGen AI competes by offering broader language support and faster rendering times at competitive pricing. The retail sector’s approach to market competition provides interesting parallels to how AI video platforms position themselves against established players.

FAQs

What is HeyGen AI net worth?

HeyGen AI achieved a valuation of $500 million following its June 2024 Series A funding round led by Benchmark. The company demonstrated strong revenue growth reaching $100 million in annual recurring revenue by October 2025.

How much revenue does HeyGen AI generate?

HeyGen AI reached $100 million in annual recurring revenue by October 2025. The company grew from $1 million ARR in early 2023 to $35 million by June 2024, demonstrating 1,024% year-over-year growth.

Who founded HeyGen AI?

Joshua Xu and Wayne Liang co-founded HeyGen AI in 2020. Both founders attended Carnegie Mellon University, with Xu previously working as a lead engineer at Snapchat. The company originally launched as Surreal before rebranding.

What makes HeyGen AI different from competitors?

HeyGen AI offers superior lip-sync accuracy, natural avatar movements, and support for 140+ languages with 230+ avatars. The platform provides comprehensive video creation tools including AI script generation, auto-translation, and URL-to-video conversion in one interface.

Has HeyGen AI acquired any companies?

HeyGen AI has not completed any acquisitions since its 2020 founding. The company focused on organic growth and internal product development rather than acquisition-driven expansion, maintaining operational efficiency with approximately 157 employees.