Med-PaLM 2 Key Stats

Med-PaLM 2 represents Google‘s breakthrough in medical artificial intelligence. Built on the PaLM 2 foundation model, this healthcare-focused large language model achieved expert-level performance on medical licensing examinations. Google Research and Google DeepMind teams collaborated to develop this system, which processes clinical questions with unprecedented accuracy.

The model underwent rigorous evaluation by physician panels across multiple countries. Published research in Nature Medicine validated its capabilities against established medical benchmarks. Med-PaLM 2 now powers MedLM, Google Cloud’s healthcare AI offering available to enterprise customers including major hospital systems.

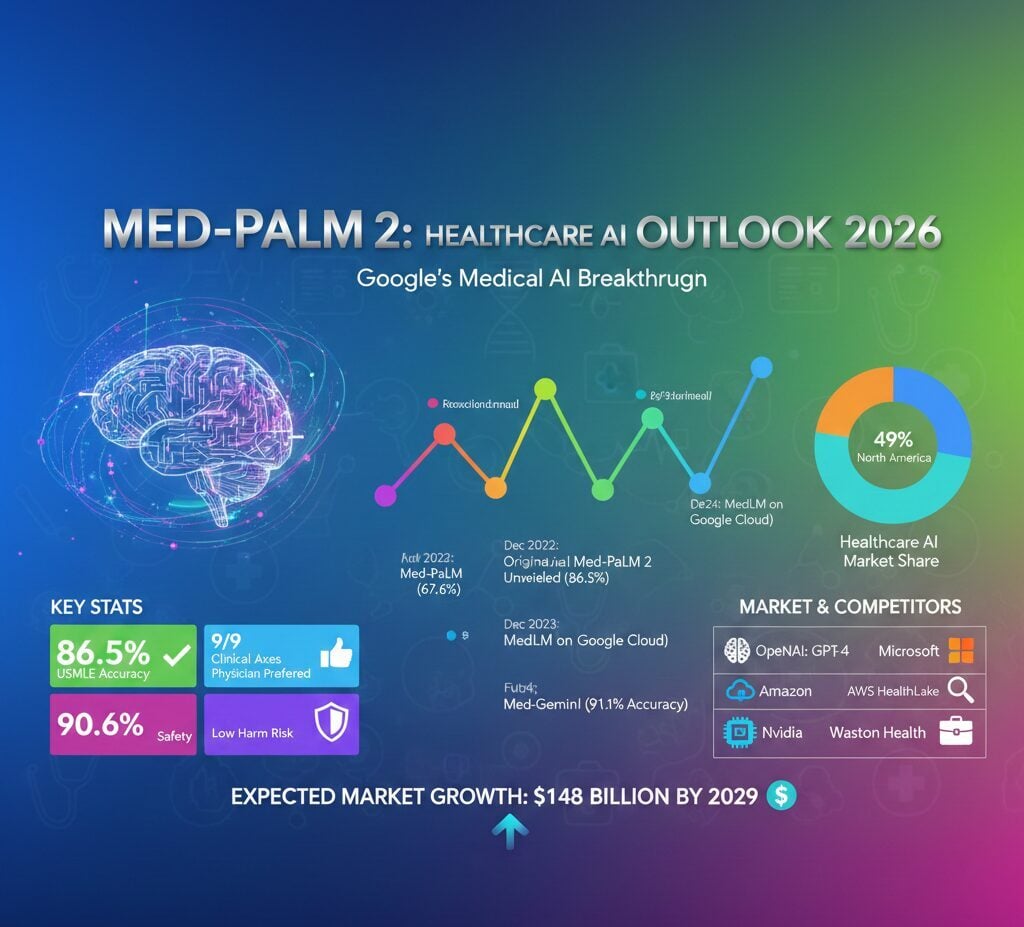

- 86.5% accuracy on USMLE-style medical exam questions, exceeding the 60% passing threshold

- Physicians preferred Med-PaLM 2 answers over physician-generated responses on 8 of 9 clinical axes

- 90.6% of adversarial test responses demonstrated low risk of potential harm

- 1,066 consumer medical questions evaluated in physician preference studies

- 19% accuracy improvement over the original Med-PaLM model

Med-PaLM 2 History

The development of Med-PaLM traces back to Google’s broader efforts in healthcare AI. Google Brain and DeepMind researchers recognized that general-purpose language models could transform medical question answering with proper domain adaptation. The project evolved through multiple iterations, each bringing substantial improvements in safety and accuracy.

Google Research preprinted the original Med-PaLM paper, introducing the first AI system to surpass the 60% passing mark on USMLE-style questions with 67.6% accuracy.

Google Health unveiled Med-PaLM 2 at The Check Up annual event, announcing 86.5% accuracy on MedQA benchmarks and expert-level performance on medical licensing examinations.

Researchers published the comprehensive Med-PaLM 2 paper on arXiv, detailing ensemble refinement techniques and physician evaluation frameworks across nine clinical axes.

The original Med-PaLM research was published in Nature, establishing foundational benchmarks for medical AI evaluation and introducing the MultiMedQA benchmark suite.

Google Cloud announced MedLM general availability through Vertex AI, with enterprise customers including HCA Healthcare and Highmark Health beginning pilot programs.

Med-PaLM 2 research was published in Nature Medicine, while Med-PaLM M multimodal capabilities expanded to radiology, dermatology, and genomics applications.

Med-PaLM 2 Key Researchers

Med-PaLM 2 emerged from collaboration between Google Research and Google DeepMind teams. The project brought together machine learning specialists and clinical experts to ensure both technical excellence and medical relevance. These researchers pioneered novel evaluation frameworks now standard in healthcare AI assessment.

Med-PaLM 2 Competitors

The medical AI landscape features intense competition from technology giants and specialized healthcare companies. OpenAI’s GPT-4 demonstrated strong medical reasoning capabilities, achieving 81.4% on MedQA benchmarks. Microsoft integrated these capabilities into healthcare products through its Azure platform.

IBM Watson Health pioneered enterprise medical AI before its 2022 divestiture to Francisco Partners. The healthcare AI sector has attracted significant investment, with startups focusing on specialized clinical applications from radiology to drug discovery.

Hardware providers like Nvidia enable these systems through specialized GPU infrastructure. Amazon Web Services offers competing healthcare AI services through its HealthLake platform. The market continues evolving rapidly as new entrants challenge established players.

| Company | Product/Model | Focus Area |

|---|---|---|

| OpenAI | GPT-4 / GPT-4o | General medical reasoning, clinical documentation |

| Microsoft | Azure Health Bot, Nuance DAX | Clinical documentation, patient engagement |

| Amazon | AWS HealthLake, Comprehend Medical | Health data analytics, NLP for medical records |

| IBM | Watson Health (legacy) | Oncology, clinical trials, imaging |

| Nvidia | Clara, BioNeMo | Medical imaging AI, drug discovery |

| Anthropic | Claude | Medical question answering, clinical reasoning |

| Epic Systems | Cognitive Computing Platform | EHR integration, clinical decision support |

| Tempus | Tempus AI Platform | Precision medicine, genomic analysis |

| PathAI | AISight | Pathology, diagnostic imaging |

| Babylon Health | Babylon AI | Symptom checking, telehealth triage |

Healthcare AI Market Revenue

Med-PaLM 2 operates within a healthcare AI market experiencing explosive growth. Industry analysts project the sector will expand from approximately $21 billion in 2024 to over $148 billion by 2029. This represents a compound annual growth rate exceeding 48%, driven by increasing adoption across hospital systems and pharmaceutical companies.

Domain-specific AI adoption in healthcare organizations increased sevenfold between 2024 and 2025. Hospital systems lead adoption rates at 27%, followed by outpatient facilities and insurance payers. Machine learning applications dominate current spending, with medical imaging and diagnostics capturing the largest segment share.

Healthcare AI Market Capitalization

While Med-PaLM 2 doesn’t have standalone market capitalization as a Google product, Alphabet Inc. reached a $3 trillion market valuation in September 2025. Google Cloud’s healthcare AI offerings contribute to the company’s enterprise revenue growth, though specific healthcare segment figures remain undisclosed.

The broader healthcare AI market valuation reflects substantial investor confidence. Publicly traded healthcare AI companies have seen significant valuation increases, with the sector attracting billions in venture funding annually. North America accounts for approximately 49% of global healthcare AI market share.

Med-PaLM 2 Related Technologies

Google expanded Med-PaLM 2 capabilities through several related developments. Med-PaLM M introduced multimodal biomedical AI with 84 billion parameters, processing clinical language alongside medical imaging and genomics data. This unified model achieved competitive performance across all 14 MultiMedBench tasks spanning radiology, dermatology, and pathology.

MedLM represents the commercial deployment vehicle for Med-PaLM 2 technology through Google Cloud. Enterprise customers access two model variants: a large complex model for sophisticated reasoning and a medium fine-tunable model for customization. HCA Healthcare pilots MedLM integration with Augmedix to convert physician-patient conversations into structured medical notes.

China Medical University Hospital in Taiwan became the first Asian university hospital to adopt the technology. The focus centers on clinical documentation automation, reducing administrative burden for healthcare providers. Google continues research into Med-Gemini, the next generation achieving 91.1% accuracy on USMLE-style questions through uncertainty-guided web search capabilities.

FAQs

What is Med-PaLM 2 accuracy on medical exams?

Med-PaLM 2 achieved 86.5% accuracy on USMLE-style medical licensing examination questions, significantly exceeding the 60% passing threshold and reaching expert-level performance according to physician evaluations.

Who developed Med-PaLM 2?

Google Research and Google DeepMind teams collaboratively developed Med-PaLM 2, with key researchers including Karan Singhal, Shekoofeh Azizi, and Alan Karthikesalingam leading the project.

How does Med-PaLM 2 compare to GPT-4?

Med-PaLM 2 scored 86.5% on MedQA versus GPT-4’s 81.4%. Physician evaluations found Med-PaLM 2 demonstrated lower likelihood of harm and no bias across demographic subgroups.

Is Med-PaLM 2 available for clinical use?

Med-PaLM 2 powers MedLM on Google Cloud’s Vertex AI platform. Select enterprise healthcare customers including HCA Healthcare and Highmark Health are testing it in pilot programs.

What is the healthcare AI market size?

The global healthcare AI market was valued at approximately $21 billion in 2024 and is projected to reach over $148 billion by 2029, growing at a CAGR of 48.1%.