Mistral 7B represents a paradigm shift in language model efficiency. The 7.3 billion parameter model was released by Paris-based Mistral AI in September 2023 under the Apache 2.0 license.

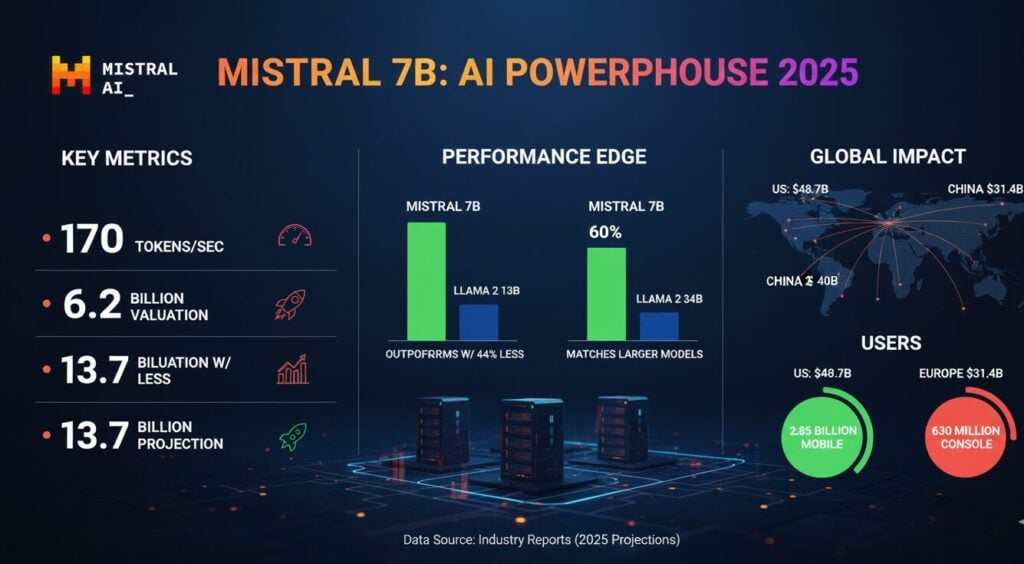

The company behind the model experienced remarkable growth, jumping from a $260 million valuation to $6.2 billion within twelve months. Revenue climbed from $10 million in 2023 to $30 million in 2024.

The model delivers performance comparable to systems three times its size while requiring only 6.2GB of VRAM in quantized form. This efficiency makes advanced AI capabilities accessible to organizations without massive infrastructure investments. Architecture innovations like Grouped-Query Attention and Sliding Window Attention enable faster inference speeds than traditional transformer designs.

Mistral 7B History

Mistral AI Co-founders

Mistral 7B Revenue

Mistral AI generated $30 million in revenue during 2024, representing 200% year-over-year growth from the $10 million earned in 2023. The company projects revenue will reach $60 million in 2025.

The revenue growth stems from multiple streams. Enterprise customers pay for API access and custom deployments. The company offers Pro, Team, and Enterprise tiers for products like Le Chat. Partnerships with Microsoft, Amazon Bedrock, and Databricks expand distribution channels.

Mistral AI Marketcap

Mistral AI’s valuation trajectory shows exceptional investor confidence. The company started at $260 million in June 2023 and reached $6.2 billion by June 2024. The September 2025 funding round pushed valuation to $13.7 billion.

This growth placed Mistral as the fourth most valuable AI company globally and the first outside the San Francisco Bay Area. ASML’s €1.3 billion investment gave the Dutch chip maker an 11% stake.

Mistral AI Acquisitions

Mistral AI has not completed any acquisitions since its founding in April 2023. The company focused on organic growth and strategic partnerships rather than inorganic expansion through mergers and acquisitions.

The startup made one investment in Atlys, though details remain limited. This approach differs from competitors like OpenAI and Google, which pursued aggressive acquisition strategies to expand capabilities.

Reports emerged in August 2025 that Apple discussed acquiring Mistral AI, with the French startup seeking a $10 billion valuation. Apple services chief Eddy Cue advocated for the deal, but no transaction materialized. The discussions highlighted Mistral’s strategic value in the competitive AI landscape.

The company prioritized partnerships instead. Microsoft, Amazon, Databricks, IBM, and Nvidia invested in or partnered with Mistral AI. These relationships provided distribution channels and resources without diluting the founders’ control.

Mistral 7B Competitors

| Competitor | Key Product | Market Position |

|---|---|---|

| OpenAI | GPT-4, ChatGPT | Market leader with $500 billion valuation |

| Anthropic | Claude | Safety-focused with $40 billion valuation |

| Gemini | Tech giant with integrated ecosystem | |

| Meta | LLaMA | Open-source alternative with massive resources |

| Cohere | Command | Enterprise-focused language models |

| Perplexity AI | Perplexity Search | AI-powered search engine |

| DeepSeek | DeepSeek-V2 | Chinese competitor with open models |

| Inflection AI | Pi | Conversational AI assistant |

| Hugging Face | Model Hub | Open-source platform and community |

| AI21 Labs | Jurassic | Enterprise language models |

Mistral 7B competes in a crowded market dominated by well-funded American companies. OpenAI leads with ChatGPT serving 800 million weekly active users and a $500 billion valuation. Anthropic raised $4 billion from Amazon and focuses on AI safety.

Google leverages its search dominance and cloud infrastructure. Meta releases open-source models like LLaMA to maintain relevance. These competitors possess significantly larger resources than Mistral AI.

Mistral differentiates through open-source commitment and European positioning. The company released model weights under Apache 2.0 license, enabling developers to customize and deploy without restrictions. This transparency appeals to enterprises concerned about vendor lock-in.

Performance benchmarks show Mistral 7B achieves results comparable to models three times its size. The model scores approximately 60% on MMLU benchmarks, matching Llama 34B. Commonsense reasoning tests show 69% accuracy, surpassing Llama 2 13B.

FAQs

What makes Mistral 7B different from other language models?

Mistral 7B uses Sliding Window Attention and Grouped-Query Attention to achieve performance equivalent to 21 billion parameter models while requiring only 6.2GB VRAM. The Apache 2.0 license allows unrestricted commercial use.

How much does Mistral 7B cost to use?

Input tokens cost $0.03 per million and output tokens cost $0.05 per million. This pricing represents approximately three times cost savings compared to models with equivalent capabilities.

Who founded Mistral AI and when?

Arthur Mensch, Guillaume Lample, and Timothée Lacroix founded Mistral AI in April 2023. The three researchers previously worked at Google DeepMind and Meta before starting the company in Paris.

What is Mistral AI’s current valuation?

Mistral AI reached a valuation of €11.7 billion ($13.7 billion) in September 2025 following a €1.7 billion funding round led by ASML. This marks significant growth from $260 million in June 2023.

Can Mistral 7B run on consumer hardware?

Mistral 7B requires only 6.2GB VRAM in quantized form, enabling deployment on consumer-grade GPUs. The 32,768-token context window and Rolling Buffer Cache provide 8x memory efficiency improvements over traditional architectures.