Key Stats

- Market capitalization of $20.41 billion as of November 20251

- More than 9,000 Dollar Tree stores across North America

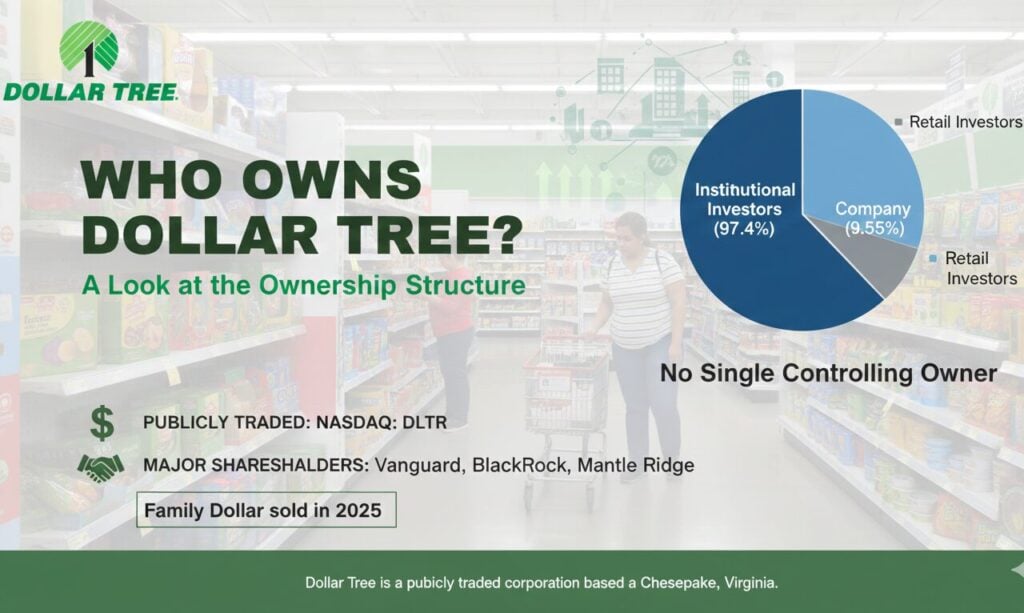

- Institutional investors control approximately 97.4% of shares

- Family Dollar sold for $1.007 billion to private equity in July 2025

Dollar Tree operates as a publicly traded corporation with no single controlling owner. The discount retailer trades on NASDAQ under ticker symbol DLTR, with ownership distributed among institutional investors, individual shareholders, and company insiders.

The company completed a transformative transaction in July 2025, selling Family Dollar to Brigade Capital Management and Macellum Capital Management for approximately $1 billion. Dollar Tree now operates exclusively under the Dollar Tree and Dollar Tree Canada brands with roughly 150,000 associates.

The retailer continues expanding its multi-price strategy, offering products beyond its traditional $1.25 price point, reaching up to $7 in select locations. Recent data shows the company attracting higher-income shoppers, with 60% of new customers earning over $100,000 annually.

Who Owns Dollar Tree?

Dollar Tree ownership reflects a structure common among major American retailers. Institutional investors hold approximately 97.4% of outstanding shares. Company insiders own roughly 9.55%, while retail investors hold the remaining portion.

This distributed ownership means no single entity maintains majority control. Major asset management firms influence corporate governance through voting rights and shareholder meetings. The company headquarters remain in Chesapeake, Virginia, where operations have been based since its founding.

Public Trading Status

Dollar Tree went public in 1995 on NASDAQ, enabling rapid expansion through capital market access. The company’s ownership structure differs significantly from competitors like Walmart, which maintains substantial family ownership. Similar to how Dollar General structures its ownership, institutional investors dominate the shareholder base.

Largest Shareholders of Dollar Tree

Institutional investment firms dominate Dollar Tree ownership. These major asset managers wield considerable influence through voting rights at shareholder meetings. Their collective holdings shape strategic decisions and corporate governance policies.

Vanguard Group

Vanguard Group maintains the largest position in Dollar Tree stock, holding approximately 11.22% of outstanding shares2. This translates to roughly 23.26 million shares. The investment giant manages these holdings primarily through index funds and mutual accounts tracking market indices.

Vanguard’s stake provides significant voting power in corporate governance matters. The firm’s passive investment approach typically supports management recommendations while maintaining oversight standards.

BlackRock

BlackRock holds the second-largest position, owning approximately 7.54% of Dollar Tree shares. The asset management firm controls around 16.43 million shares. BlackRock’s confidence reflects broader institutional support for the discount retail business model that also benefits Target Corporation and similar value retailers.

Mantle Ridge and Other Holders

Activist investor Mantle Ridge LP owns roughly 5.63% of Dollar Tree, representing 12.1 million shares. Unlike passive investors, Mantle Ridge actively participates in strategic discussions and board composition decisions.

T. Rowe Price holds 4.61% of shares. State Street Corporation owns 4.34%. Several firms expanded positions significantly in late 2024.

Who Is on the Board of Directors for Dollar Tree?

Dollar Tree’s board expanded from nine to twelve directors in February 2025. The board provides strategic oversight while ensuring accountability to shareholders across multiple disciplines.

Executive Leadership

Edward J. Kelly III serves as Chairman of the Board since November 2024. Kelly brings extensive financial services experience from senior positions at Citigroup, including Chairman of Global Banking and Chief Financial Officer.

Michael C. Creedon Jr. joined the board in February 2025 upon his permanent appointment as Chief Executive Officer. Creedon initially joined Dollar Tree in 2022 as Chief Operating Officer before becoming interim CEO in November 2024. His prior experience includes nearly a decade at Advance Auto Parts, where he served as Executive Vice President.

Financial and Operational Expertise

William W. Douglas III brings three decades of experience from the Coca-Cola system in information technology, finance, and supply chain. Timothy A. Johnson adds over 30 years of retail leadership, currently serving as Chief Financial and Administrative Officer for Victoria’s Secret & Co.

Independent Directors

Paul C. Hilal, founder of Mantle Ridge LP, represents one of Dollar Tree’s largest activist shareholders. His presence ensures alignment between significant investors and corporate strategy.

Additional independent directors include Cheryl W. Grisé, Daniel J. Heinrich, Jeffrey G. Naylor, and Stephanie P. Stahl with technology expertise essential for competing with major e-commerce platforms.

History of Dollar Tree Co-founders

Dollar Tree traces its origins to 1986 when three entrepreneurs launched a revolutionary retail concept. Doug Perry, Macon Brock, and Ray Compton founded the company under the name Only $1.00, starting with five locations across Georgia, Tennessee, and Virginia.

Early Ventures and K&K Toys

Before establishing Dollar Tree, the founding team gained retail experience through K&K Toys, a mall-based toy store chain that grew to over 130 locations along the East Coast. The founders sold K&K Toys to KB Toys in 1991, allowing them to concentrate exclusively on expanding their dollar store concept.

Brand Evolution

The first store branded as Dollar Tree opened on April 27, 1989, at Jessamine Mall in Sumter, South Carolina. By 1993, management changed the corporate name from Only $1.00 to Dollar Tree Stores.

The 1995 public offering on NASDAQ marked a pivotal moment, enabling rapid expansion through capital markets. The founders’ vision of quality merchandise at a single price point resonated with cost-conscious consumers. This differentiated Dollar Tree from Dollar General’s multi-price model established decades earlier.

FAQ

Who is the largest shareholder of Dollar Tree?

Vanguard Group holds the largest stake in Dollar Tree with approximately 11.22% ownership, representing 23.26 million shares as of 2025.

Does Dollar General own Dollar Tree?

No. Dollar General and Dollar Tree operate as separate publicly traded companies competing in the discount retail market with distinct ownership structures and management teams.

Who is the current CEO of Dollar Tree?

Michael C. Creedon Jr. serves as Chief Executive Officer. He was permanently appointed in December 2024 after joining the company as Chief Operating Officer in 2022.

Is Dollar Tree still a dollar store?

Dollar Tree has evolved beyond its original single-price concept. While maintaining $1.25 as a core price point, stores now offer multi-price items reaching up to $7 in expanded format locations.

What happened to Family Dollar?

Dollar Tree sold Family Dollar to Brigade Capital Management and Macellum Capital Management for $1.007 billion in July 2025, completing the transaction after acquiring it in 2015 for $8.5 billion.