Key Stats

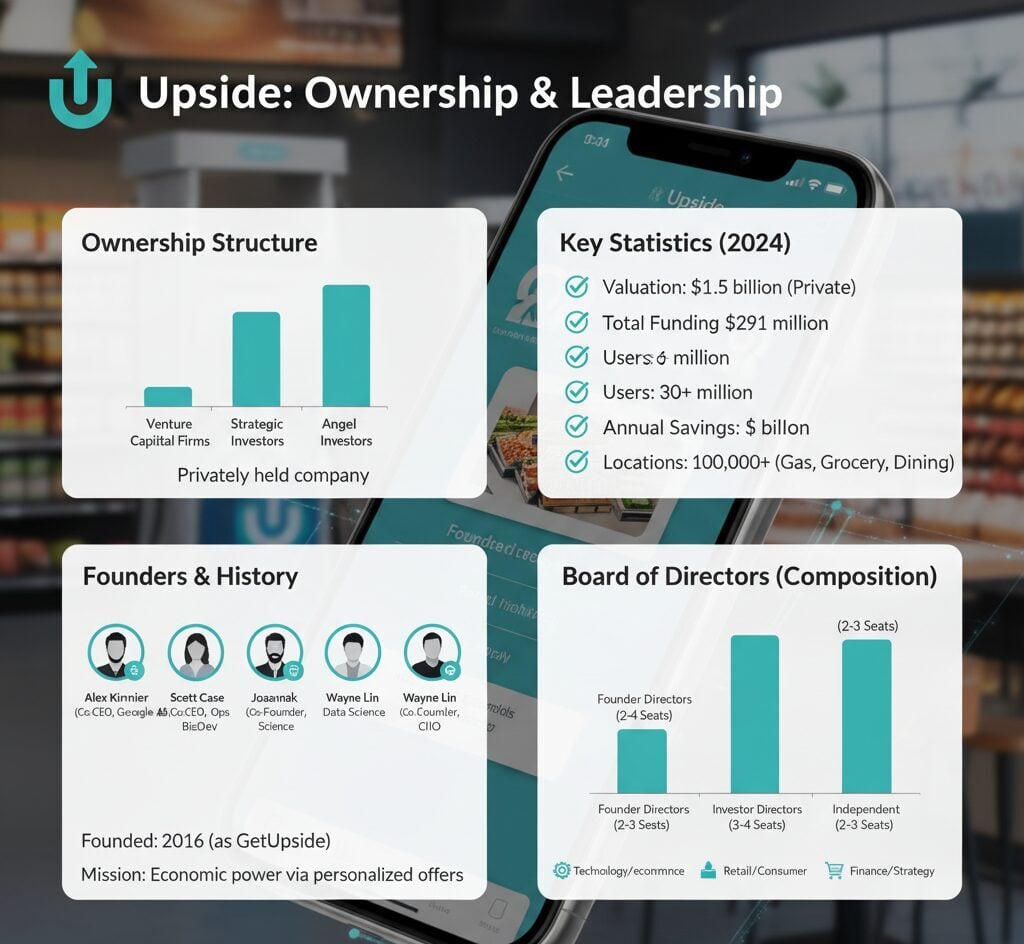

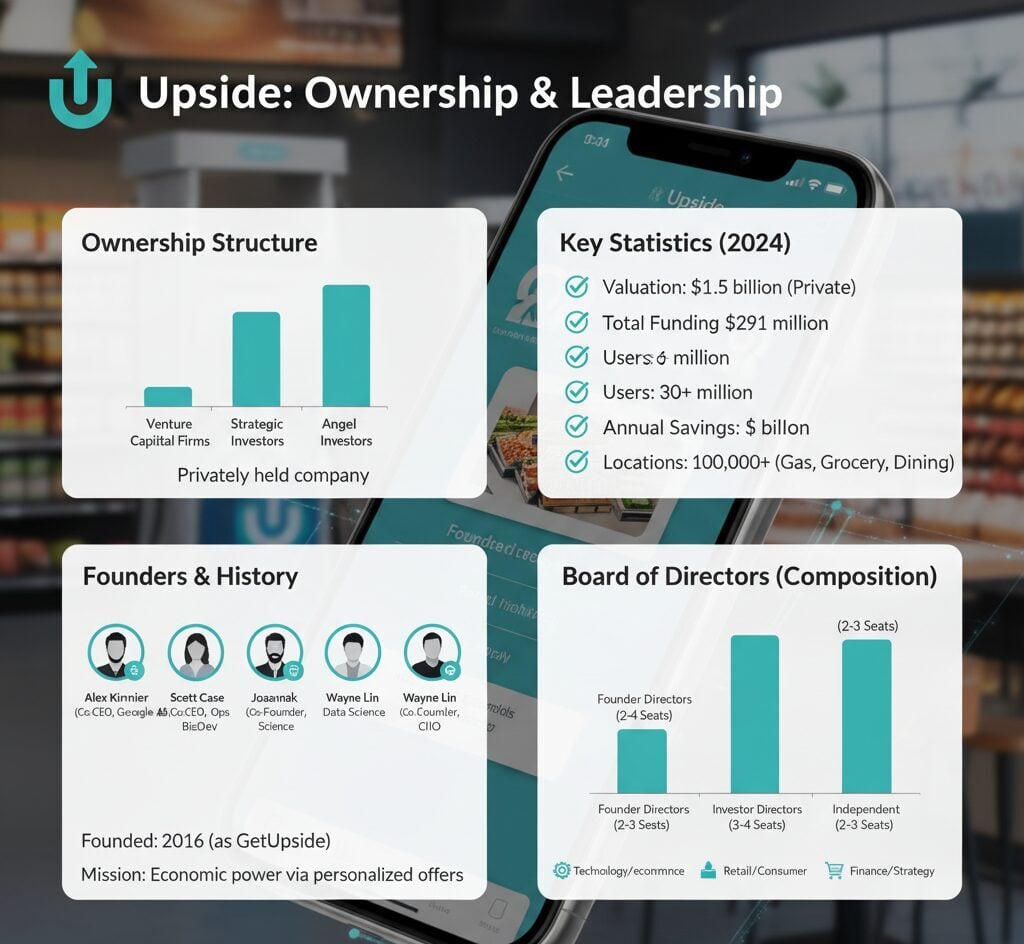

- Upside holds a valuation of $1.5 billion as a private company

- The company has raised $291 million in total funding across multiple rounds

- Over 30 million users save approximately $2 billion annually through the platform

- More than 100,000 participating locations across gas stations, grocery stores, and restaurants

Upside is owned by Upside Services, Inc., a privately held company founded by Alex Kinnier, Scott Case, Joanna Kochaniak, Wayne Lin, and Rick McPhee. The ownership structure includes the founding team, institutional investors such as General Catalyst, Bessemer Venture Partners, and Vista Equity Partners, along with individual angel investors. Unlike publicly traded companies, Upside maintains private ownership, allowing its founders and investors to retain control over strategic decisions.

Since its launch in 2016 as GetUpside before rebranding to Upside, the cashback app has transformed how consumers save money on everyday purchases. The platform partners with over 100,000 businesses nationwide, offering users cash back on gas, groceries, and dining. With frequent users earning an average of $270 annually and the company having distributed over $800 million in total cashback rewards, Upside has established itself as a leading player in the cashback app market. The company operates with a mission to advance economic power in the real world by connecting consumers with local merchants through personalized offers driven by machine learning technology.

Who Owns Upside?

Upside ownership lies within a private company structure, where control is distributed among key stakeholders rather than public shareholders. This arrangement allows the company to focus on long-term growth strategies without the pressure of quarterly earnings reports that public companies face.

The primary ownership groups of Upside include the founding team, venture capital firms, and individual angel investors. Each group brings different resources and expertise to support the company’s expansion and technological development.

Founders and Leadership Ownership

The founding team maintains substantial equity stakes in Upside. Co-CEOs Alex Kinnier and Scott Case lead the company alongside co-founders Joanna Kochaniak, Wayne Lin, and Rick McPhee. Their ownership positions align their personal success with the company’s performance, creating strong incentives for continued innovation and growth.

Institutional Investor Stakes

Major venture capital firms hold minority ownership positions in Upside through their investment rounds. These institutional investors provide not only capital but also strategic guidance and industry connections that help accelerate company growth.

Employee Ownership Programs

Upside likely offers employee stock option plans, allowing team members to acquire ownership stakes over time. This approach helps the company attract top talent and ensures employees are invested in the company’s success.

Largest Shareholders of Upside

The shareholder composition of Upside reflects a diverse group of investors who have supported the company through various funding stages. Understanding who these shareholders are provides insight into the strategic direction and financial backing of the organization.

General Catalyst

General Catalyst stands as one of the most prominent venture capital investors in Upside. This firm has a strong track record of investing in technology companies that transform traditional industries. Their participation in multiple funding rounds, including the $100 million conventional debt round in April 2022, demonstrates continued confidence in the business model.

The firm brings extensive experience in scaling consumer technology platforms. Their involvement extends beyond capital investment to include strategic advisory services that help Upside navigate growth challenges and market expansion opportunities.

Bessemer Venture Partners

Bessemer Venture Partners represents another significant shareholder in Upside. This established venture capital firm has a long history of backing successful technology startups. Their investment philosophy aligns well with the consumer-focused approach that drives success in the cashback rewards industry.

The partnership with Bessemer provides access to a network of portfolio companies and industry experts. This connection helps Upside identify partnership opportunities and best practices from other successful consumer technology platforms.

Vista Equity Partners

Vista Equity Partners participated in the company’s funding rounds, bringing expertise in software and technology investments. The firm specializes in enterprise software, data, and technology-enabled businesses, which complements the data-driven personalization model that powers cashback offers on the platform.

Additional Institutional Investors

Other notable institutional shareholders include DCVC, Jefferies, Capital One Ventures, and Builders VC. Each investor contributes unique industry expertise and resources. Capital One Ventures, for instance, brings deep understanding of consumer financial services, while DCVC offers insights into data science and artificial intelligence applications.

Major Investor Categories

Individual Angel Investors

Several prominent individual investors hold stakes in Upside. Notable angel investors include Elad Gil, a well-known technology investor and entrepreneur, Gokul Rajaram, who brings extensive experience from his time at major tech companies, and Hal Varian, a distinguished economist who served as advisor to founder Alex Kinnier during the company’s early development.

These individual investors often provide more than just capital. Their personal networks, operational expertise, and strategic advice contribute significantly to shaping company direction and opening doors to partnership opportunities.

History of Upside Co-founders

The founding story of Upside begins with a team of entrepreneurs who recognized an opportunity to bridge the gap between online commerce efficiency and brick-and-mortar retail. Their diverse backgrounds in technology, economics, and business operations laid the foundation for a revolutionary approach to consumer savings.

Alex Kinnier – Co-Founder and Co-CEO

Alex Kinnier serves as co-founder and co-CEO of Upside, bringing extensive experience from his tenure at Google. During his time there, he built the large advertiser ad-server system, gaining deep insights into digital advertising and data-driven decision making. His vision of using technology and data to help brick-and-mortar businesses compete more effectively drove the initial concept for the platform.

Kinnier’s background in large-scale system architecture and his understanding of how data can optimize business outcomes became fundamental to the personalized offer engine that powers the cashback app. His leadership focuses on technology innovation and maintaining the company culture as the organization scales.

Scott Case – Co-Founder and Co-CEO

Scott Case joined as co-founder and co-CEO, bringing complementary skills in business development and operations. His experience in building and scaling technology companies provides crucial expertise in managing the complex relationships between the platform, consumers, and merchant partners. Together with Kinnier, the co-CEO structure allows specialized focus on different aspects of business growth.

Joanna Kochaniak – Co-Founder

Joanna Kochaniak co-founded Upside with a strong background in machine learning and data science. Her expertise in developing algorithms for personalized recommendations directly contributed to the sophisticated pricing engine that calculates customized cashback offers for individual users. This technology represents a significant advancement beyond traditional one-size-fits-all loyalty programs.

Wayne Lin – Co-Founder and Chief Product Officer

Wayne Lin serves as co-founder and holds leadership positions in product and operations. His focus on user experience and product development ensures the app remains intuitive and valuable for millions of users. Lin also functions as an angel investor, supporting other startups in the technology ecosystem.

Rick McPhee – Co-Founder and Chief Investment Officer

Rick McPhee co-founded the company and serves as Chief Investment Officer, overseeing financial strategy and investment decisions. His role includes managing relationships with institutional investors and ensuring the company maintains strong financial health as it pursues expansion opportunities.

Who Is on the Board of Directors for Upside?

The board of directors for Upside provides strategic oversight and governance, guiding major company decisions while ensuring accountability to shareholders. While specific board member names remain largely private, the typical composition of a venture-backed company board includes representatives from key investor groups, independent directors, and company founders.

Founder Representatives

Co-CEOs Alex Kinnier and Scott Case likely hold board seats, providing direct founder input into strategic decisions. Their presence ensures that operational realities and company culture considerations factor into board deliberations. Founder board members typically advocate for long-term vision over short-term gains, maintaining focus on the original mission of transforming brick-and-mortar commerce.

The founder board members bring institutional knowledge about product development, technology capabilities, and merchant relationships. This expertise proves invaluable when evaluating expansion opportunities or considering significant strategic pivots.

Investor Representatives

Representatives from major investors such as General Catalyst, Bessemer Venture Partners, and Vista Equity Partners likely occupy board seats. These investor directors bring experience from serving on multiple boards and can provide comparative insights from other portfolio companies in similar markets.

Investor board members often chair important committees such as audit, compensation, and governance. Their experience in evaluating financial performance and assessing management effectiveness helps ensure strong corporate governance practices. They also facilitate connections to potential business partners and help recruit executive talent when needed.

Independent Directors with Technology Expertise

Private companies at the scale of Upside typically add independent directors who bring specialized expertise in areas critical to business success. Directors with backgrounds in consumer technology, mobile applications, and digital marketing likely contribute perspectives on product development and user acquisition strategies.

Independent technology directors help the company stay current with rapidly evolving trends in mobile commerce, data privacy regulations, and user experience design. Their connections within the technology community can facilitate partnerships with other platforms and technology providers.

Directors with Retail and Consumer Industry Experience

Given the focus on serving brick-and-mortar merchants in gas, grocery, and restaurant sectors, board members with deep retail industry knowledge provide crucial insights. These directors understand the challenges facing physical retailers and can guide strategy for merchant acquisition and relationship management.

Retail industry directors help bridge the gap between technology capabilities and merchant needs. Their experience with traditional commerce operations informs decisions about feature development and partnership terms that work for both the platform and participating businesses.

Financial and Strategic Planning Expertise

Board members with financial and strategic planning backgrounds contribute to decisions about fundraising, capital allocation, and potential acquisition opportunities. As Upside approaches a potential IPO or considers strategic alternatives, directors with public company experience become increasingly valuable.

These directors help evaluate whether to pursue additional funding rounds, when to invest in new market expansion, and how to balance growth investments against profitability goals. Their experience with similar companies provides benchmarks for assessing performance and setting realistic targets.

Typical Board Composition

FAQs

Is Upside a publicly traded company?

No, Upside remains a privately held company owned by its founders, venture capital investors, and angel investors. The company’s shares are not available for purchase on stock exchanges like NASDAQ.

Who are the main investors in Upside?

General Catalyst, Bessemer Venture Partners, and Vista Equity Partners represent the largest institutional investors. Additional investors include DCVC, Capital One Ventures, and individual angels like Elad Gil and Gokul Rajaram.

Could Upside go public in the future?

While possible, Upside has not announced IPO plans. The company’s $1.5 billion valuation and strong growth trajectory position it well for a potential public offering when market conditions and strategic timing align favorably.

How does private ownership affect Upside users?

Private ownership allows Upside to focus on user experience and merchant relationships rather than quarterly profit pressures. This structure enables investment in technology improvements and expansion that benefit users through better offers and more participating locations.

What happens if Upside ownership changes?

Ownership changes through acquisition or additional investment rounds could affect strategy. However, new owners would likely maintain the core business model that makes the platform valuable, as seen with similar acquisitions like Amazon purchasing Whole Foods Market.