Key Stats

- Total U.S. national debt stands at $38.43 trillion as of January 2026 (Joint Economic Committee)

- Japan leads foreign U.S. debt holders with approximately $1.18 trillion in Treasury securities

- Debt-to-GDP ratio reached 122.6% at the end of fiscal year 2025

- Annual interest payments on the national debt surpassed $1 trillion in 2025 (CRFB)

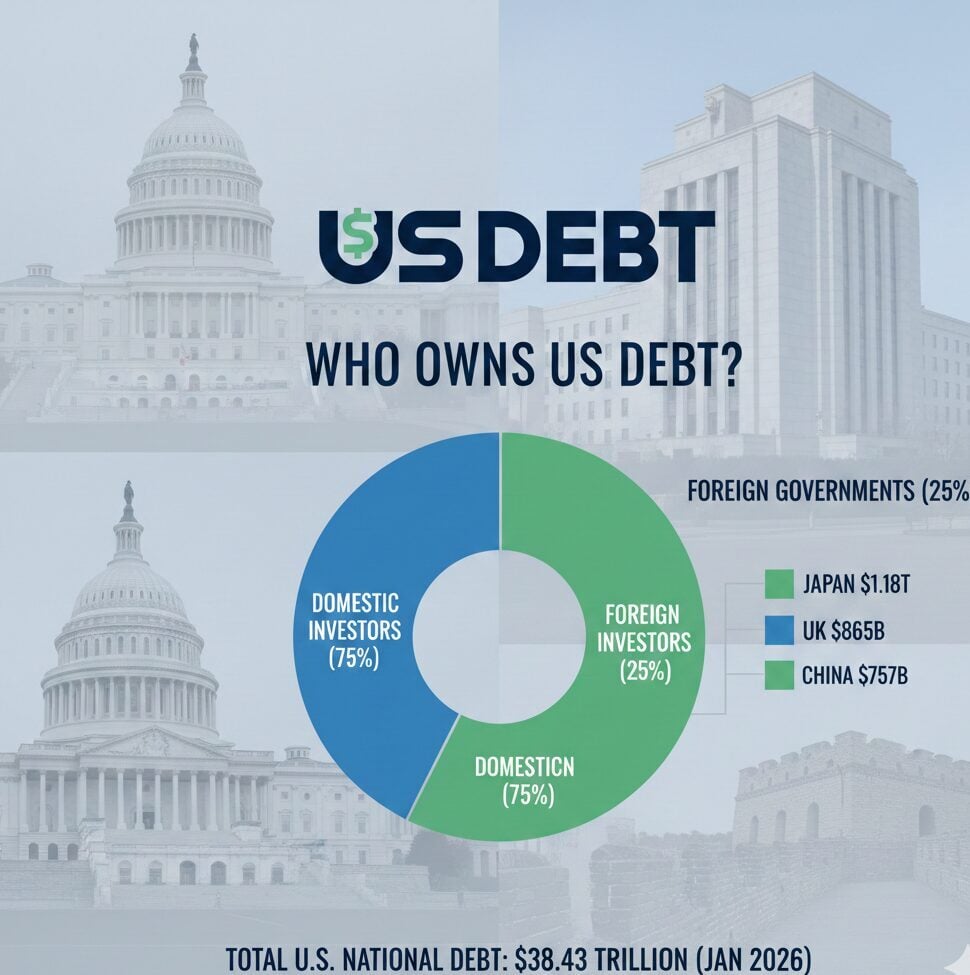

The U.S. national debt is primarily owned by domestic investors and institutions, including the Federal Reserve, mutual funds, and pension funds, which collectively hold about 75% of total debt. The remaining 25% belongs to foreign governments and international investors. Japan currently holds the largest share of foreign-owned U.S. debt at roughly $1.18 trillion, followed by the United Kingdom and China.

The debt reached $38.43 trillion in January 2026, an increase of $2.25 trillion from the previous year. Interest payments now exceed $1 trillion annually, making debt servicing one of the largest federal expenses.

Who Owns U.S. Debt?

U.S. national debt ownership falls into three main categories: domestic private investors, intragovernmental holdings, and foreign investors. Domestic investors hold approximately 55% of total debt, while intragovernmental holdings account for about 20%.

Domestic Debt Holders

The Federal Reserve System remains the largest single domestic holder with approximately $4.6 trillion. Major asset management firms and mutual funds collectively hold around $3.7 trillion. Depository institutions, including major financial institutions, hold approximately $1.6 trillion in Treasury securities.

Foreign Debt Ownership

Foreign governments and investors own roughly 25% of U.S. debt, totaling around $9 trillion. This percentage has declined from a peak of 34% in 2013, despite the dollar amount increasing.

Largest Foreign Holders of U.S. Debt

Foreign nations invest in U.S. Treasury securities to maintain foreign exchange reserves, manage currency valuations, and earn stable returns. The composition of foreign holders has shifted notably over the past decade.

Japan: Leading Foreign Creditor

Japan holds approximately $1.18 trillion in U.S. Treasury securities, making it the largest foreign holder of American debt. The country surpassed China as the top foreign holder in 2019. Japanese institutional investors and the central bank purchase Treasuries to manage exchange rates and maintain stable foreign reserves.

United Kingdom and China

The United Kingdom has emerged as the second-largest foreign holder with approximately $865 billion in Treasury securities. European financial institutions often use the UK as a custodial center for their U.S. investments. China currently holds around $757 billion, down from over $1.3 trillion in 2013 due to trade tensions and diversification strategies.

Other Notable Foreign Holders

Several financial centers appear prominently among foreign debt holders. Luxembourg holds approximately $421 billion, reflecting its role as a hub for global investment funds. Canada and Belgium each hold over $360 billion. Ireland, the Cayman Islands, and Switzerland also maintain significant positions as conduits for international investment flows.

History of U.S. National Debt

The United States has carried national debt since its founding. The Revolutionary War left the young nation with approximately $43 million in debt by 1783.

Early Debt Management

Alexander Hamilton established the federal bond system to manage post-war obligations, creating the foundation for modern Treasury securities. President Andrew Jackson briefly paid off the entire national debt in 1835, the only time in American history the nation was debt-free.

Modern Debt Expansion

The Civil War pushed debt to approximately $2.7 billion by 1865. World Wars and the debt ceiling establishment in 1939 created the current framework. Since 2000, debt has grown from $5.7 trillion to over $38 trillion, driven by stimulus programs, COVID-19 relief measures, and ongoing deficits.

Key Government Entities Managing U.S. Debt

Several institutions play critical roles in managing and overseeing the national debt through issuance, trading, and monitoring of Treasury securities.

U.S. Department of the Treasury

The Treasury Department manages all federal government debt operations through the Bureau of the Fiscal Service. It conducts regular auctions where primary dealers, including major investment banks, bid on new securities.

Federal Reserve System

The Federal Reserve holds approximately $4.6 trillion in Treasury securities as part of its monetary policy operations. Through open market operations, the Fed influences interest rates and economic conditions via its network of member banks, including major banking organizations.

Trust Funds and Institutional Investors

Social Security and Medicare trust funds hold approximately $2.7 trillion in special Treasury securities. Private institutions also maintain substantial portfolios, with Berkshire Hathaway holding over $314 billion. Major financial services firms like JPMorgan Chase manage trillions in government debt through mutual funds. Payment networks including Visa and Mastercard also hold Treasury securities for liquidity management.

FAQs

Who is the largest holder of U.S. debt?

Domestic investors collectively hold the most U.S. debt at approximately 55%. The Federal Reserve is the single largest holder with about $4.6 trillion in Treasury securities.

How much U.S. debt does China own?

China holds approximately $757 billion in U.S. Treasury securities, representing about 8.9% of all foreign-held debt, ranking third behind Japan and the United Kingdom.

Can the U.S. default on its national debt?

The United States has never defaulted on its debt obligations. Congress typically raises the debt ceiling to allow continued borrowing.

What happens if foreign countries stop buying U.S. debt?

Reduced foreign demand could push interest rates higher. However, U.S. Treasuries remain attractive globally due to their safety and liquidity.

How much does the U.S. pay in interest on national debt annually?

Annual interest payments exceeded $1 trillion in 2025, surpassing defense spending. Interest is now the second-largest federal expense after Social Security.