Key Stats

Airbnb operates in 220+ countries with over 8 million active listings globally

Market capitalization of approximately 85 billion dollars as of 2025

Three co-founders control over 84% combined ownership through special voting shares

Listed on Nasdaq Stock Exchange under ticker symbol ABNB since December 2020

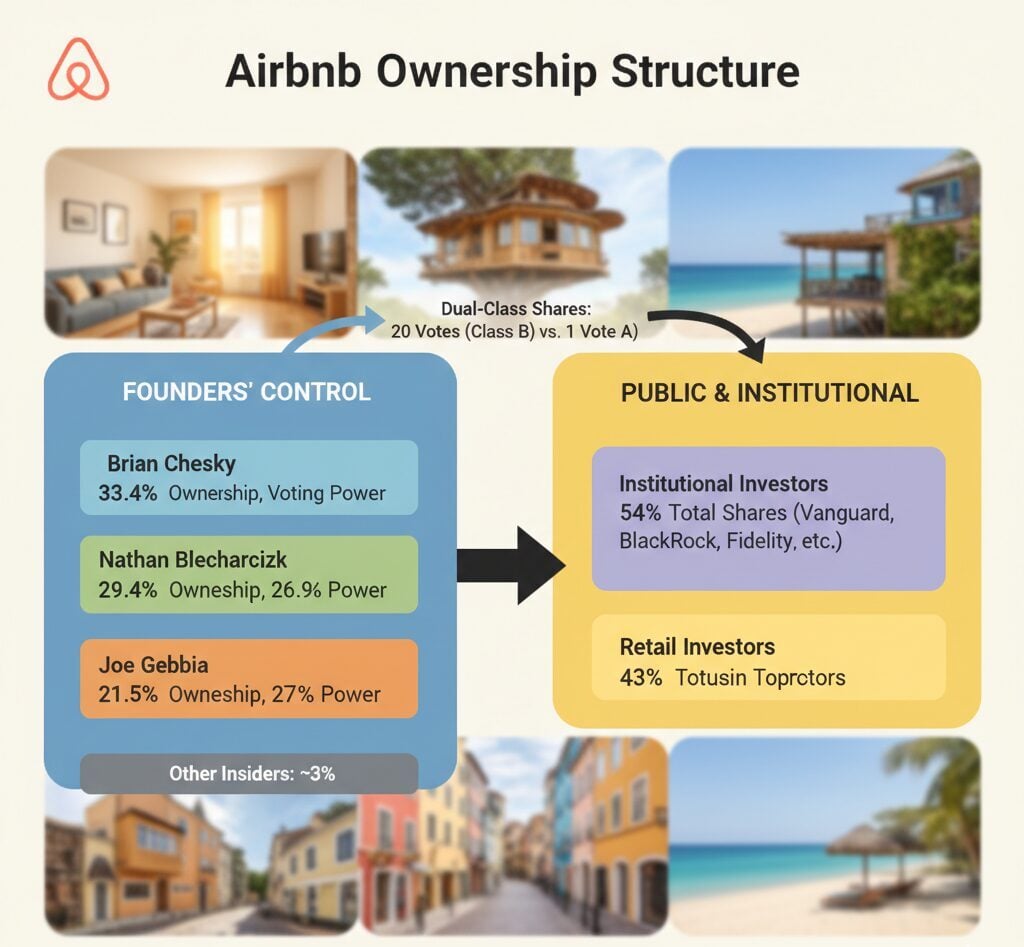

Airbnb ownership remains primarily in the hands of its three co-founders who maintain substantial control through a dual-class share structure. Brian Chesky, Nathan Blecharczyk, and Joe Gebbia collectively own over 84% of the company through Class B shares that carry 20 votes each. Institutional investors including Vanguard, BlackRock, and Fidelity hold significant positions in Class A shares.

The vacation rental platform continues expanding its global footprint with over 8 million active accommodation listings across 220+ countries. Recent financial performance shows trailing twelve-month revenue reaching 11.6 billion dollars, demonstrating the company’s strong market position despite regulatory challenges in various markets. Travel guidance platforms and accommodation services continue evolving as consumer preferences shift toward authentic local experiences.

Who Owns Airbnb?

Airbnb operates as a publicly traded entity on the Nasdaq Stock Market, yet its ownership structure differs significantly from typical public companies. The three co-founders retain primary control through Class B common stock, which provides disproportionate voting power compared to publicly traded Class A shares.

Founder Control Through Special Share Structure

Brian Chesky commands the largest individual stake with more than 76 million Class B shares, representing 33.4% economic ownership and 30.6% voting control. Nathan Blecharczyk follows with over 64 million Class B shares, translating to 29.4% ownership and 26.9% voting authority. Joe Gebbia maintains nearly 47 million Class B shares, equating to 21.5% ownership and 27% voting control [1].

Institutional and Public Shareholders

Institutional investors hold approximately 54% of total outstanding shares, primarily Class A shares with limited voting power. Individual retail investors own roughly 43% of shares through public markets. The remaining percentage belongs to company insiders beyond the founding trio. This arrangement allows founders to maintain strategic direction while providing liquidity opportunities for public investors.

Largest Shareholders of Airbnb

The shareholder composition reflects a careful balance between founder control and public market participation. While institutional investors collectively hold the majority of outstanding shares, the dual-class structure ensures founders maintain decision-making authority over strategic matters.

Top Institutional Holdings

The Vanguard Group leads institutional investors with approximately 37.45 million shares, representing 8.73% of outstanding stock valued at around 4.68 billion dollars. BlackRock manages 19.65 million shares or 4.58% of the company, worth approximately 2.46 billion dollars [2].

State Street Corporation holds 18.05 million shares, accounting for 4.21% ownership valued at 2.25 billion dollars. Harris Associates increased its position substantially by 43.2% to reach 14.24 million shares or 3.32% of the company. Fidelity Management & Research maintains 13.36 million shares representing 3.11% ownership worth 1.67 billion dollars.

Early Venture Capital Investors

Sequoia Capital participated as an early backer during Airbnb’s private funding rounds, contributing to the company’s growth trajectory before going public. The venture firm’s initial investment yielded substantial returns following the December 2020 initial public offering. Morgan Stanley served as one of the lead underwriters for the IPO, helping facilitate the public market debut.

Private equity firms maintain approximately 10% stake in the company, providing strategic guidance alongside financial backing. These investors bring operational expertise from managing portfolio companies across hospitality, technology, and consumer services sectors. Their involvement helps ensure accountability while supporting management’s long-term vision.

Insider Trading Activity

Recent insider transactions show a pattern tilted toward selling rather than accumulating shares. Joseph Gebbia executed sales of 236,000 shares at prices ranging from 129 to 130 dollars per share. Company officers including Elinor Mertz and David Bernstein conducted smaller transactions, with most sales remaining modest in size relative to total holdings. These disposals may reflect personal financial planning rather than lack of confidence in business prospects.

History of Airbnb Co-founders

The founding story began in August 2008 when three roommates struggled to afford rent in San Francisco. Brian Chesky and Joe Gebbia decided to inflate air mattresses in their apartment, offering temporary lodging to attendees of a local design conference. They created a simple website called “Air Bed and Breakfast” to market their unconventional accommodation solution.

Brian Chesky: Design Thinking Leader

Brian Chesky serves as Chief Executive Officer, bringing industrial design expertise from his education at Rhode Island School of Design. Before founding Airbnb, he worked as an industrial designer, developing skills in user experience and product development. His design background influences the company’s approach to creating intuitive digital experiences that connect hosts with travelers seamlessly.

Chesky’s leadership emphasizes community building and belonging, reflected in the company mission statement encouraging people to belong anywhere. Under his direction, the platform evolved from spare room rentals to encompassing entire properties, unique accommodations, and curated experiences across global markets.

Nathan Blecharczyk: Technical Foundation

Nathan Blecharczyk joined as the third co-founder, contributing critical engineering capabilities. His computer science background from Harvard University equipped him to build the technical infrastructure supporting millions of transactions. Blecharczyk previously held engineering positions at companies including OPNET Technologies before dedicating his skills to the startup.

As Chief Strategy Officer, he now focuses on long-term planning and strategic initiatives. His technical acumen proved essential in scaling platform operations to handle exponential growth while maintaining reliability and security for users worldwide.

Joe Gebbia: Creative Visionary

Joe Gebbia graduated from Rhode Island School of Design with dual degrees in Graphic Design and Industrial Design. His artistic sensibility shaped the brand identity and user interface aesthetics that differentiate the platform from competitors. Gebbia currently serves as Chairman of Airbnb.org, the company’s nonprofit organization focused on emergency housing and crisis response.

His board positions at companies including Tesla demonstrate broader business interests beyond the core vacation rental business. Gebbia’s creative approach continues influencing product development and design innovation across the organization.

Who is on the Board of Directors for Airbnb?

The board composition balances founder representation with independent directors bringing diverse industry expertise. This governance structure provides oversight while respecting founder vision through the special voting share arrangement.

Technology and Product Leadership

Brian Chesky serves as both Chief Executive Officer and board member, maintaining direct influence over strategic direction. Nathan Blecharczyk participates as board member alongside his Chief Strategy Officer responsibilities. Their dual roles ensure founder perspectives remain central to governance decisions while benefiting from outside director counsel.

Angela Ahrendts joined the board in 2019, bringing extensive retail and technology experience from her tenure as Senior Vice President of Retail at Apple. Prior to Apple, she served as CEO of luxury brand Burberry for eight years, leading the company’s successful transformation and tripling its business value. Her expertise in creating seamless customer experiences across physical and digital channels provides valuable insights for platform evolution.

Finance and Investment Expertise

Kenneth Chenault brings financial services leadership from his former role as CEO of American Express. His decades of experience navigating complex financial markets and building customer loyalty programs offer strategic guidance for payment systems and trust mechanisms. Chenault’s understanding of consumer behavior patterns helps shape policies around transactions and user protection.

Amrita Ahuja joined the board in 2023, serving as Chief Financial Officer at Block, formerly known as Square. Her financial management expertise and experience with payment technology companies strengthens the board’s understanding of evolving fintech solutions. Ahuja holds degrees from Duke University and Harvard Business School, contributing analytical rigor to board deliberations. She serves on the Audit Committee, providing oversight of financial reporting and internal controls.

Technology and Media Background

Ann Mather offers technology industry perspective from board positions at Google, Pixar, Netflix, and Arista Networks. Her experience spans entertainment, cloud computing, and consumer internet services. As former Chief Financial Officer at Pixar and Disney, Mather understands content creation, distribution models, and subscription business economics. Her cross-industry knowledge helps evaluate strategic opportunities and competitive threats.

Nonprofit and Community Focus

Joe Gebbia represents founder interests while chairing Airbnb.org, the nonprofit entity established in 2020 to coordinate emergency housing responses during crises. The organization facilitates temporary stays for people displaced by natural disasters, conflicts, and humanitarian emergencies. Board governance separates commercial operations from philanthropic initiatives while maintaining alignment with company values around community and belonging.

The directors collectively oversee risk management, executive compensation, strategic investments, and major corporate actions. Their varied backgrounds spanning retail, finance, technology, and nonprofit sectors provide comprehensive perspective on opportunities and challenges facing the global hospitality marketplace. Board committees address specialized areas including audit, compensation, and corporate governance, ensuring proper oversight mechanisms exist throughout the organization.

FAQs

Is Airbnb privately or publicly owned?

Airbnb trades publicly on the Nasdaq Stock Exchange under ticker symbol ABNB since December 2020. However, founders maintain majority voting control through Class B shares, giving them more influence than typical public companies.

What percentage of Airbnb do the founders own?

The three co-founders collectively own approximately 84% of the company economically. Brian Chesky holds 33.4%, Nathan Blecharczyk owns 29.4%, and Joe Gebbia maintains 21.5% through their Class B shareholdings.

How much did Airbnb raise in its IPO?

The initial public offering in December 2020 raised over 3.5 billion dollars. The company debuted with a valuation exceeding 100 billion dollars, making it one of the largest technology IPOs of that year.

Who are the biggest institutional investors in Airbnb?

The Vanguard Group holds the largest institutional position with 8.73% ownership. BlackRock owns 4.58%, State Street controls 4.21%, Harris Associates maintains 3.32%, and Fidelity holds 3.11% of outstanding shares.

How does the dual-class share structure work?

Class B shares held by founders carry 20 votes each, while publicly traded Class A shares have one vote each. This structure allows founders to control decision-making despite owning less than 50% economically.