Key Stats

Parent Company: Kering (100% ownership)

2025 Revenue: $1.76 billion

Brand Value: $122 million (2025)

Current CEO: Gianfranco Gianangeli (since January 2025)

Kering owns Balenciaga completely. The French luxury goods conglomerate acquired the iconic fashion house in 2001, bringing it under the same corporate umbrella as Gucci and other prestigious brands. This strategic acquisition transformed an avant-garde fashion powerhouse into one of the most talked-about luxury labels globally.

The house generates an estimated $1.76 billion in annual revenue through ready-to-wear collections, footwear, handbags, and accessories. Its creative director, Demna, has redefined luxury streetwear while maintaining the architectural precision that founder Cristóbal Balenciaga pioneered. Recent leadership changes reflect Kering’s commitment to strengthening the brand’s market position, with Gianfranco Gianangeli assuming the CEO role in January 2025.

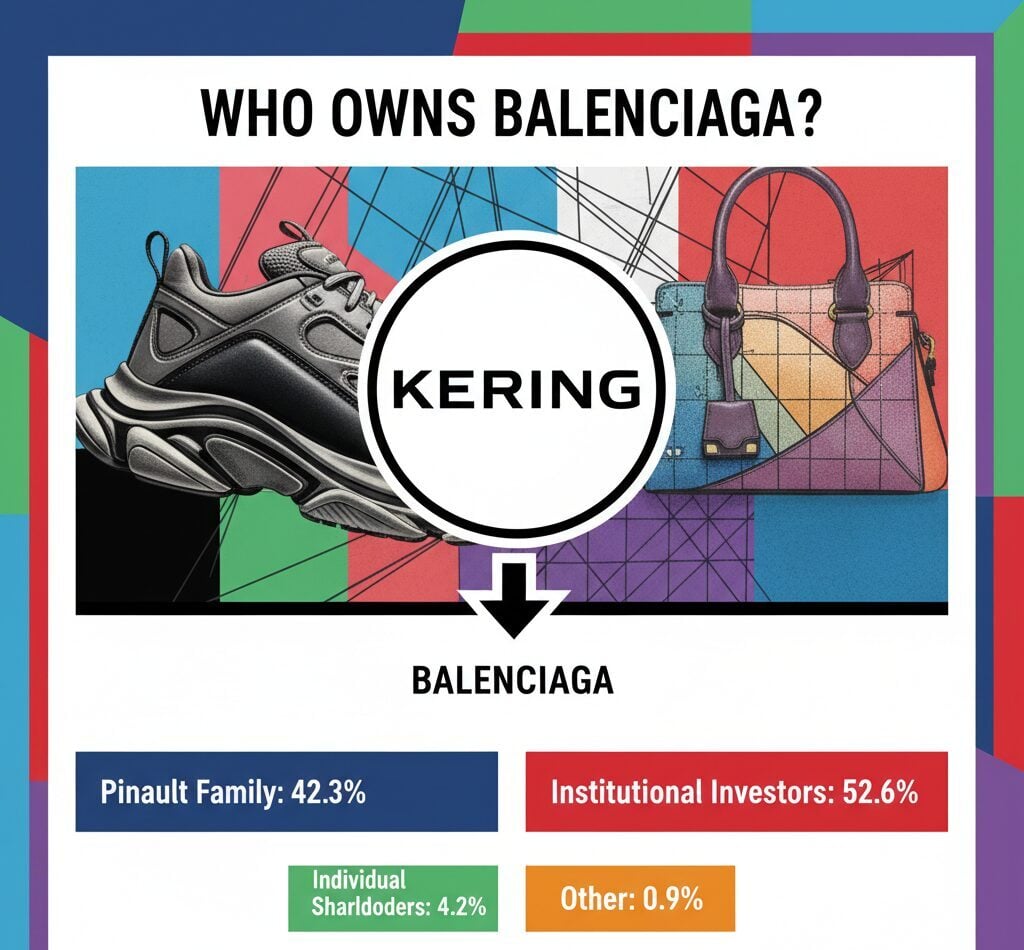

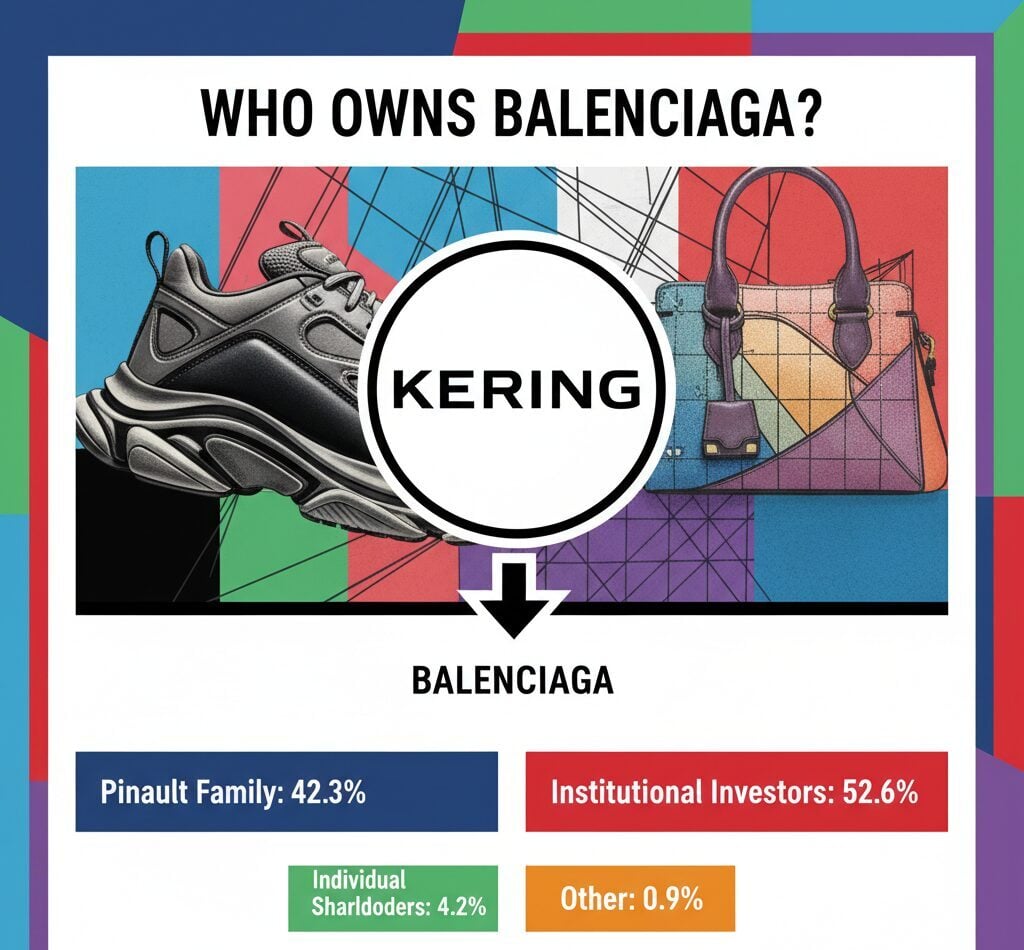

Who Owns Balenciaga?

Kering maintains 100% ownership of this luxury fashion house. No independent shareholders exist outside of Kering’s corporate structure.

The brand operates as a fully-integrated subsidiary within Kering’s diverse portfolio of luxury labels. Behind Kering stands the Pinault family, who control approximately 42.3% of Kering’s share capital through their holding company Artémis. This gives them substantial influence over all strategic decisions affecting the fashion house.

Institutional investors hold roughly 52.6% of Kering’s shares, while individual shareholders account for about 4.2%. Employee and executive shares comprise another 0.2%, with treasury shares making up 0.7%.

The Acquisition Timeline

The acquisition happened in 2001 when Gucci Group purchased approximately 90-91% of the capital. Over time, Kering consolidated its position to achieve full ownership.

This move enabled global expansion, improved distribution networks, and strengthened the brand’s retail infrastructure significantly. The integration into Kering’s portfolio provided access to resources that accelerated growth across all product categories.

Kering Ownership Structure

History of Balenciaga and Its Founder

Cristóbal Balenciaga: The Master Couturier

Born in 1895 in Spain, Cristóbal Balenciaga learned tailoring basics from his mother, who worked as a seamstress. By age twelve, he was already creating garments. His first boutique opened in San Sebastián in 1919.

The Spanish Civil War forced him to relocate to Paris in 1937, where he established his legendary atelier. This move proved transformative, positioning him at the epicenter of global fashion.

Revolutionary Design Philosophy

Christian Dior called him “the master of us all.” Cristóbal revolutionized women’s fashion through architectural precision. He created the barrel line silhouette in 1947, challenging waist-focused designs prevalent in post-war fashion.

The semi-fitted suit followed in 1951. His 1957 sack dress eliminated the waistline entirely, liberating women from restrictive fashions. These weren’t just clothes but sculptural statements that redefined feminine silhouettes.

Legacy and Revival

He retired in 1968 and passed away in 1972 in Valencia, Spain. The brand remained dormant for nearly two decades. Its revival began in 1986, with Nicolas Ghesquière joining as creative director in 1997, modernizing the aesthetic.

Alexander Wang took over in 2012, followed by Demna in 2015. Each creative director has reinterpreted Cristóbal’s architectural vision for contemporary audiences. The founder’s emphasis on structure, proportion, and innovation continues defining the house’s identity today.

Board of Directors for Balenciaga

Corporate Governance Structure

As a fully-owned subsidiary, the fashion house doesn’t maintain an independent board. Kering’s corporate board oversees strategic decisions across all portfolio brands, including this one.

François-Henri Pinault serves as chairman and CEO of Kering. His role encompasses all luxury houses within the group, providing unified strategic direction while allowing individual brand expression.

Executive Leadership Team

Gianfranco Gianangeli has led as CEO since January 2, 2025. His background includes senior positions at Saint Laurent, where he optimized retail operations and strengthened market positioning.

He oversees all global divisions: ready-to-wear, footwear, handbags, accessories, retail subsidiaries, and e-commerce platforms. His mandate focuses on balancing bold creativity with commercial excellence.

Demna serves as creative director. Appointed in 2015, he’s responsible for all design initiatives and creative vision, continuing the house’s tradition of architectural innovation while embracing contemporary streetwear influences.

Kering Board Oversight

Jean-François Palus serves as group managing director at Kering. He directly influences subsidiary operations through financial oversight and strategic planning, ensuring alignment with group objectives.

The Kering board includes independent directors with expertise in luxury retail, finance, and international business. They review performance metrics across all houses quarterly, providing governance and accountability.

Strategic Decision-Making

Major decisions require Kering board approval. This includes capital investments exceeding certain thresholds, leadership changes, and strategic partnerships that could impact brand positioning.

Day-to-day operations remain under the CEO’s authority. He collaborates with the creative director to balance commercial objectives with artistic expression, maintaining the delicate equilibrium essential in luxury fashion.

Regional Management Structure

Regional presidents manage specific geographic markets. These executives report to the CEO while adapting global strategies to local consumer preferences and market dynamics.

North America, Europe, and the Asia-Pacific each have dedicated leadership teams. They handle retail operations, marketing campaigns, and distribution channels within their territories, responding to regional nuances while maintaining global brand coherence.

Largest Shareholders of Balenciaga

The Pinault Family Through Artémis

François Pinault founded Établissements Pinault in 1963 as a timber trading company. His family’s holding entity, Artémis, now wields considerable power within the luxury goods sector.

Their 42.3% stake in Kering translates into outsized voting rights and decision-making authority. This influence extends to all Kering brands, including leadership appointments, sustainability initiatives, and financial strategy.

François-Henri Pinault, the current chairman and CEO of Kering, inherited this business empire. He transformed the group from retail diversification into a pure luxury play, divesting non-luxury assets to focus exclusively on high-end fashion and accessories.

His vision directly impacts how the fashion house operates globally. The family’s long-term investment horizon allows for patient capital deployment and strategic brand building without excessive pressure for short-term results.

Institutional Investment Holdings

Major asset managers own significant Kering stakes. These include pension funds, investment firms, and wealth management companies worldwide, collectively holding 52.6% of shares.

BlackRock, Vanguard, and similar institutional investors typically hold substantial positions. They provide accountability through shareholder meetings and financial oversight, monitoring performance metrics and corporate governance practices.

However, their influence remains limited compared to the Pinault family’s controlling interest. They can pressure management on performance metrics but rarely override family-driven strategic decisions regarding brand direction or major investments.

Public Market Shareholders

Individual investors collectively hold about 4.2% of Kering’s capital. This includes retail traders and smaller institutional players who trade on Euronext Paris under ticker KER.

These shareholders benefit from the group’s financial performance but exert minimal influence on operations. Their interests align with overall profitability and stock appreciation rather than specific operational strategies.

Share Capital Breakdown and Voting Rights

Voting rights generally follow the capital structure, though certain share categories carry different voting weights. This structure is common among European luxury conglomerates controlled by founding families.

Treasury shares cannot vote, meaning Kering’s 0.7% self-held shares don’t participate in shareholder decisions. Employee and executive shares represent 0.2% of capital, aligning management interests with shareholder value creation.

The structure ensures the Pinault family maintains control even as public markets provide liquidity and capital. This balance allows aggressive brand investment while preserving family governance, similar to how Christian Dior operates under the Arnault family’s control within the competitive luxury landscape alongside rivals like Louis Vuitton.

Kering vs LVMH: Comparative Market Position

| Metric | Kering (Balenciaga) | LVMH (Competitors) |

|---|---|---|

| Major Brands | Balenciaga, Gucci, Saint Laurent | Louis Vuitton, Dior, Fendi |

| Controlling Family | Pinault (via Artémis) | Arnault |

| Ownership Model | 42.3% family control | 47.4% family control |

| Stock Exchange | Euronext Paris (KER) | Euronext Paris (MC) |

FAQs

Is Balenciaga owned by Gucci?

No. Both brands operate under Kering ownership but remain separate entities with distinct creative directions. Gucci doesn’t own this fashion house.

Does LVMH own Balenciaga?

No. LVMH is Kering’s competitor in the luxury goods sector. It owns brands like Dior and Fendi but has no stake in this brand.

Who founded Balenciaga?

Cristóbal Balenciaga founded the house in 1917 in Spain. He moved operations to Paris in 1937 after the Spanish Civil War disrupted business.

Is Balenciaga publicly traded?

No. The brand doesn’t trade independently on stock exchanges. Kering trades on Euronext Paris under ticker KER, giving indirect exposure to its performance.

What percentage of Kering revenue comes from Balenciaga?

The house contributes approximately 8-10% of Kering’s total luxury goods revenue, making it a significant but not dominant portfolio asset alongside powerhouses like Gucci.