Key Stats

Nextdoor Holdings Inc. operates as a publicly traded company on the New York Stock Exchange under the ticker symbol KIND. The neighborhood network is owned by a diverse group of institutional investors, individual shareholders, and company insiders, with no single entity holding majority control.

The company transitioned from private to public ownership through a special purpose acquisition company merger with Khosla Ventures Acquisition Co. II in November 2021. This move brought significant capital to fuel expansion while distributing ownership among public shareholders and maintaining stakes for early venture capital investors.

Since its founding in 2008, Nextdoor has grown to connect neighbors in countries including the United States, United Kingdom, Germany, France, Netherlands, Italy, Spain, Sweden, Denmark, Australia, and Canada. The platform facilitates local communication, enabling residents to share recommendations, safety alerts, and community updates. Understanding the ownership structure reveals how various stakeholders influence the company’s strategic direction and commitment to building stronger neighborhoods through technology.

Who owns Nextdoor?

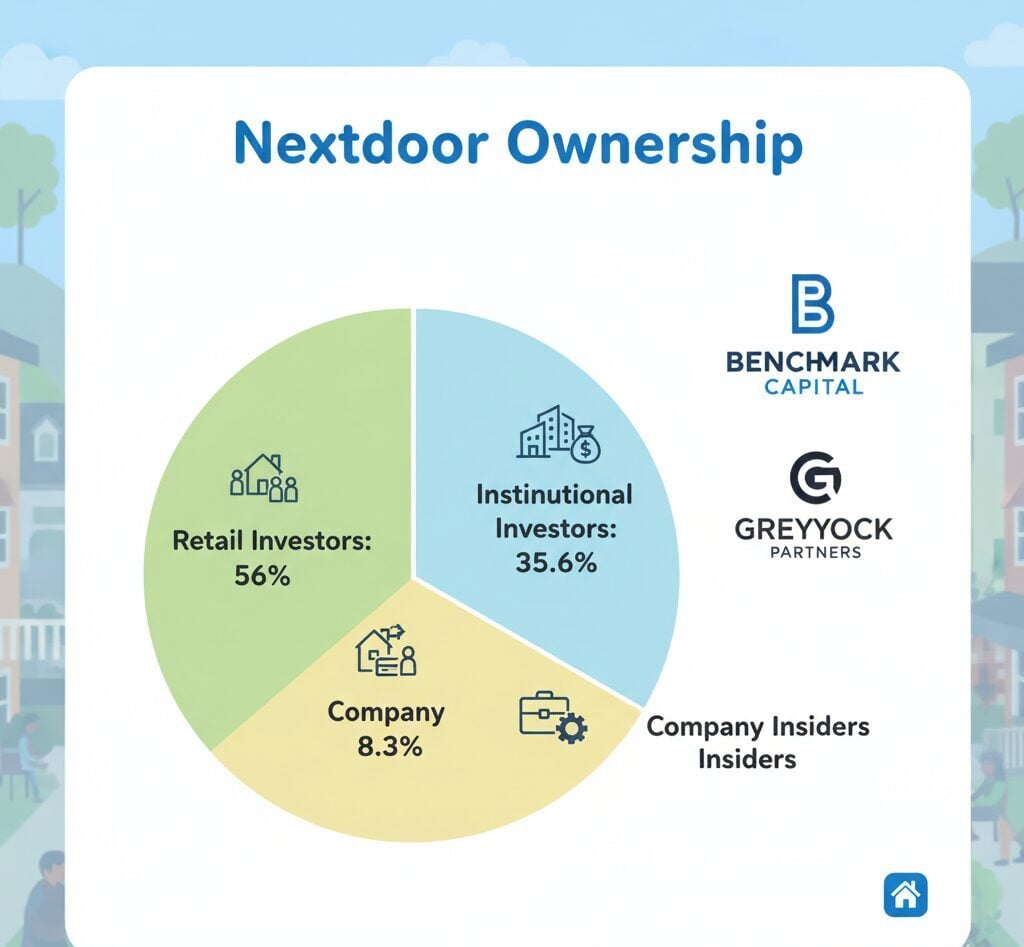

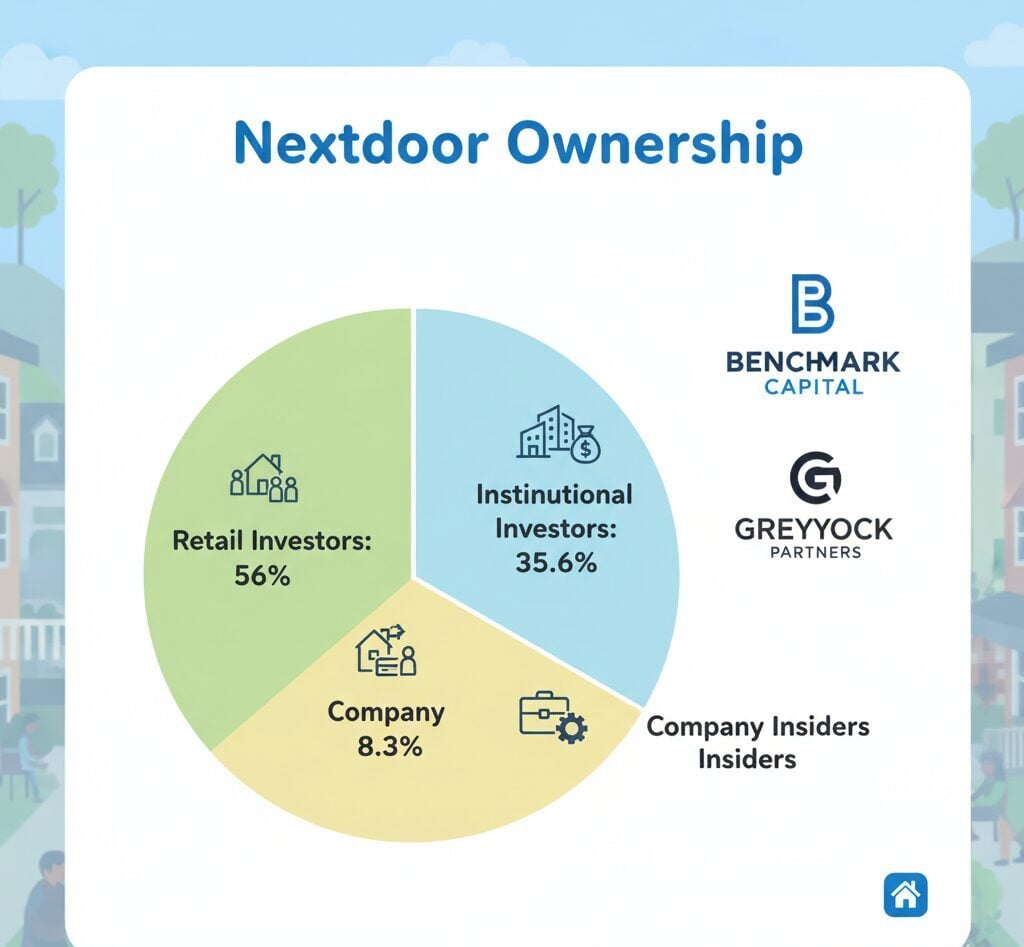

Nextdoor Holdings Inc. operates with distributed ownership across multiple stakeholder groups. Institutional investors collectively hold approximately 35.64% of the company, representing significant influence from major financial firms and investment funds. Individual retail investors own around 56.03% of outstanding shares, making them the largest ownership category. Company insiders, including founders and executives, maintain approximately 8.32% ownership.

The largest single shareholder is Benchmark Capital, holding roughly 13% of outstanding shares through various fund entities. This venture capital firm invested early in the company’s development and continues to maintain a substantial position following the public offering. Major institutional shareholders also include Vanguard Group, BlackRock, and Greylock Partners, each holding significant stakes.

Following the November 2021 SPAC merger, shares began trading publicly on the New York Stock Exchange. The transaction provided approximately $686 million in gross proceeds, combining funds from the SPAC trust account and a private investment in public equity. This capital infusion supports ongoing platform development, geographic expansion, and monetization initiatives while allowing broader public participation in ownership.

Who is on the board of directors for Nextdoor?

The Nextdoor board of directors brings together accomplished leaders from technology, finance, and operational backgrounds. This diverse group provides strategic guidance as the company navigates growth opportunities and challenges in the hyperlocal social networking space.

Executive Leadership and Founders

Nirav Tolia serves as Chief Executive Officer, President, and Chairperson of the Board of Directors. As a co-founder of Nextdoor, Tolia originally led the company from its inception before stepping aside in 2018. He returned to the CEO role in the second quarter of 2024, bringing deep institutional knowledge and renewed vision for the platform’s evolution.

Prior to founding Nextdoor, Tolia held positions as Entrepreneur-in-Residence at Benchmark Capital, Chief Operating Officer of Shopping.com, and Co-Founder and CEO of Epinions.com. His extensive experience building consumer technology companies positions him to guide Nextdoor through its next phase of development. He also serves as Non-Executive Chair of Hedosophia and co-founding director of the William S. Spears Institute for Entrepreneurial Leadership at SMU’s Cox School of Business.

Technology and Product Expertise

Marissa Mayer joined the Nextdoor board in May 2024, bringing exceptional technology leadership experience. As CEO and Founder of Sunshine Products Inc., and former President and CEO of Yahoo, Mayer understands large-scale platform operations. Her thirteen years at Google included roles as Vice President of Local, Maps and Location Services, and Vice President of Search Products and User Experience. She currently serves on the boards of Walmart and AT&T, providing valuable cross-industry perspective.

Robert Hohman, Co-Founder and Chairman of Glassdoor, also joined the board in May 2024. His experience building Glassdoor from inception demonstrates expertise in creating platforms where users share authentic information about their communities. Before founding Glassdoor in 2007, Hohman served in management roles at Hotwire and sat on the audit committee and board of OpenTable.

E-commerce and Operations

Niraj Shah, co-founder, Chief Executive Officer and Co-Chairman of Wayfair, brings expertise in building and scaling e-commerce platforms. Since co-founding Wayfair in 2002, Shah has demonstrated success in creating customer-centric marketplaces. His background includes serving as CEO of Simplify Mobile Corporation and Entrepreneur-in-Residence at Greylock Partners. Shah currently serves on multiple boards including the Shah Charitable Foundation and Cornell Tech Council.

Strategic Marketing and Operations

Elisa Steele joined the board in July 2024, bringing extensive marketing and operational expertise. She has held CEO positions at Namely and Jive Software, plus executive roles including Chief Marketing Officer at Microsoft, Skype, Yahoo, and NetApp. Steele currently serves on the boards of Amplitude, Bumble, JFrog, and Procore Technologies, demonstrating her continued engagement with growth-stage technology companies.

Venture Capital Representatives

Jason Pressman represents Shasta Ventures as a managing director and board member. His venture capital perspective helps guide strategic decisions regarding capital allocation and growth initiatives. Pressman also serves on the boards of several portfolio companies including Zuora.

David Sze serves as an advisory partner at Greylock Partners, one of Nextdoor’s early investors. Prior to joining Greylock, Sze held the position of senior vice president of product strategy at Excite and Excite@Home. His early investments in LinkedIn, Facebook, Pandora, and Roblox demonstrate strong judgment in identifying successful consumer technology platforms. Sze serves on the Board of Trustees at Yale University and Rockefeller University.

Chris Varelas, co-founder and managing partner of Riverwood Capital, brings global investment perspective to the board. Before establishing Riverwood, he served as managing director at Citigroup Global Markets. Varelas sits on multiple boards including Elemental Cognition and MotionPoint, plus advisory boards for Streamlined Ventures, Global Ventures, and the RAND Corporation’s Center for Global Risk and Security.

History of Nextdoor Co-founders

Nextdoor emerged from the vision of four Silicon Valley entrepreneurs who recognized an unmet need for authentic neighborhood connections. Nirav Tolia, Sarah Leary, Prakash Janakiraman, and David Wiesen co-founded the company in 2008, officially launching the platform in October 2011.

Early Development and Vision

The founders brought complementary skills from their experiences at major technology companies. Tolia had previously co-founded Epinions and served as COO of Shopping.com. Leary started her career at Microsoft before taking senior leadership roles at Epinions and eBay. Janakiraman began as a software engineer at Excite@Home in 1996 before moving into engineering management at Shopping.com and Epinions. Wiesen contributed technical expertise from his background in software development.

Their shared insight centered on a fundamental human need. Despite the proliferation of global social networks connecting people across continents, neighbors living on the same street often remained strangers. Traditional social media platforms failed to address hyperlocal needs, creating an opportunity for a purpose-built neighborhood network.

Securing Initial Funding

The founding team secured backing from prestigious venture capital firms who recognized the platform’s potential. Initial investments totaled significant capital from firms including Benchmark Capital, Greylock Partners, Kleiner Perkins, and Tiger Global Management. Bill Gurley of Benchmark became an early advocate and board member, providing strategic guidance during the company’s formative years.

By 2012, the platform expanded beyond its initial San Francisco Bay Area launch to neighborhoods across the United States. The founders’ instincts proved correct as user adoption accelerated, demonstrating genuine demand for neighborhood-specific social networking. This early validation attracted additional funding rounds, eventually totaling over $447 million in venture capital before the public offering.

Largest shareholders of Nextdoor

Nextdoor’s shareholder base reflects a typical post-IPO structure with institutional investors, retail shareholders, and company insiders each holding meaningful stakes. Understanding the composition provides insight into the various interests influencing corporate decisions.

Ownership Distribution

Major Institutional Shareholders

Benchmark Capital maintains the largest individual shareholder position at approximately 13% of outstanding shares. As an early investor, Benchmark supported the company through multiple funding rounds before the public offering. The firm’s continued significant stake demonstrates confidence in Nextdoor’s long-term potential and strategic direction.

Greylock Partners holds the second-largest position at roughly 8.5% through Greylock 16 GP LLC and related entities. Greylock invested early in the company’s development, recognizing the opportunity to build infrastructure for neighborhood communication. The firm’s portfolio includes other successful consumer technology companies, bringing valuable pattern recognition to board discussions.

Co-founder Nirav Tolia ranks as the third-largest shareholder with approximately 6.6% ownership. His substantial personal investment aligns his interests with other shareholders while providing him influence over strategic decisions. Following his return as CEO in 2024, this ownership stake reinforces his commitment to the company’s success.

Other Significant Institutional Investors

The Vanguard Group and BlackRock, two of the world’s largest asset managers, each hold meaningful positions in Nextdoor. These institutional investors typically maintain passive stakes through index funds and other diversified portfolios. Their presence provides liquidity and stability to the shareholder base.

Additional institutional shareholders include Nikko Asset Management Americas, Sumitomo Mitsui Trust Holdings, and ARK Investment Management. ARK’s position is particularly notable given the firm’s focus on disruptive innovation and technology-driven businesses. Cathie Wood’s investment firm participated in the PIPE financing associated with the SPAC merger.

Shasta Ventures, another early venture capital investor, maintains a significant position. The firm invested in multiple funding rounds during Nextdoor’s private phase and continues holding shares following the public offering. Comcast Ventures, the venture capital arm of the cable and media conglomerate, also maintains an ownership stake acquired through earlier investment rounds.

Insider Ownership Considerations

Company insiders collectively own approximately $126 million worth of shares based on recent valuations. This insider ownership provides meaningful alignment between management and shareholders. Beyond Tolia’s holdings, other co-founders Sarah Leary and Prakash Janakiraman maintain ownership positions from their founding roles.

Following the SPAC merger, CEO Sarah Friar and co-founders contributed portions of their personal ownership to establish the Nextdoor Kind Foundation. This nonprofit organization provides grants to support neighborhood revitalization efforts. The charitable contribution demonstrated leadership’s commitment to the company’s mission beyond financial returns.

Retail Investor Participation

Individual retail investors constitute the largest ownership category at over 56% of shares. This broad distribution reflects public market accessibility following the November 2021 listing. Retail shareholders gained the ability to participate in Nextdoor’s growth story through standard brokerage accounts, democratizing ownership beyond institutional and accredited investors.

The significant retail ownership creates both opportunities and challenges. While broad ownership aligns with Nextdoor’s mission of building inclusive communities, it also subjects the company to more volatile trading patterns compared to firms with concentrated institutional ownership. Management must balance quarterly performance expectations with long-term strategic investments.

FAQs

Who currently owns Nextdoor?

Nextdoor is publicly traded on NYSE under ticker KIND. Ownership is distributed among institutional investors holding 35.64%, retail investors with 56.03%, and company insiders owning 8.32% of outstanding shares.

When did Nextdoor go public?

Nextdoor became a publicly traded company on November 8, 2021 through a SPAC merger with Khosla Ventures Acquisition Co. II, valued at $4.3 billion at the time of the transaction.

Who is the CEO of Nextdoor?

Nirav Tolia serves as CEO, President, and Chairperson of the Board. He co-founded the company in 2008, stepped aside in 2018, and returned to lead Nextdoor in Q2 2024.

What is Nextdoor’s largest shareholder?

Benchmark Capital holds the largest institutional position at approximately 13% of outstanding shares. The venture capital firm invested early in the company and maintains its significant stake post-IPO.

How many people use Nextdoor?

Nextdoor serves 88 million verified neighbors across more than 330,000 neighborhoods worldwide in eleven countries. Nearly one in three U.S. households uses the platform to connect with their local community.