Dollar General stands as one of America’s largest discount retailers, operating over 20,500 stores across the United States and Mexico. But when it comes to ownership, this retail powerhouse presents an intricate structure that many investors and consumers find fascinating. Understanding who owns Dollar General reveals how institutional investment shapes modern American retail and how this discount chain has evolved from a family business into a publicly traded corporation with diverse shareholders.

Who Owns Dollar General Corporation: The Complete Ownership Structure

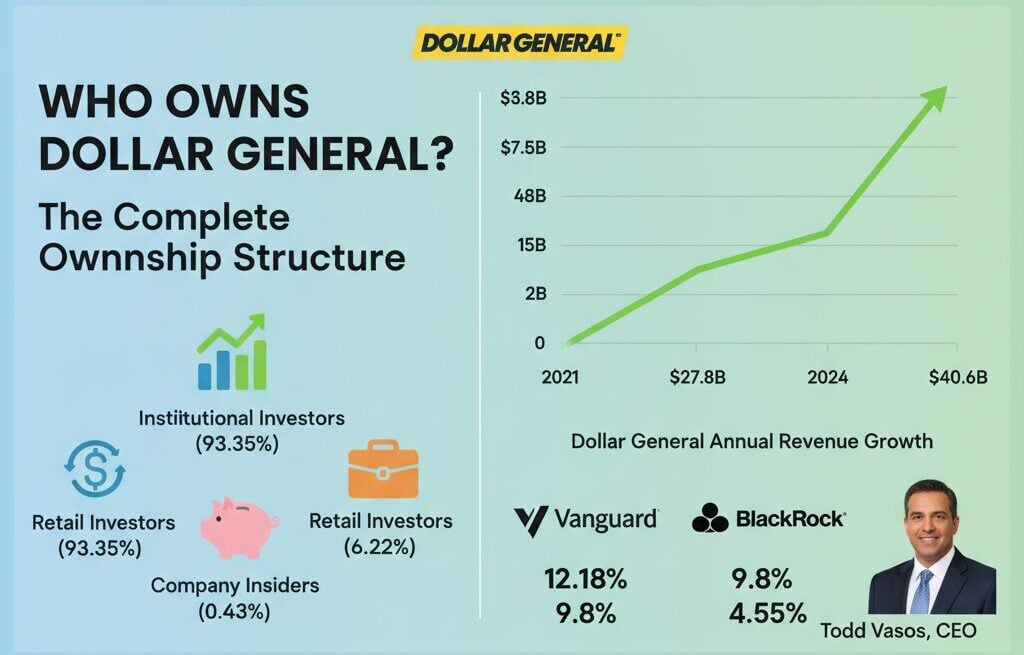

Dollar General operates as a publicly traded corporation listed on the New York Stock Exchange under the ticker symbol DG. The ownership structure of Dollar General demonstrates a clear pattern common among large American retailers: institutional investors control the vast majority of shares, while individual retail investors hold a smaller portion.

As of 2025, institutional investors own approximately 93.35 percent of Dollar General stock, with company insiders holding around 0.43 percent and retail investors owning approximately 6.22 percent. This ownership distribution means that no single person or company maintains majority control over Dollar General. Instead, ownership gets distributed among various investment firms, mutual funds, and individual shareholders who participate in the company’s growth trajectory.

Major Institutional Investors Who Own Dollar General Stock

The institutional ownership of Dollar General reveals that several major asset management firms hold significant stakes in the company. These institutional investors influence corporate governance through their voting rights and participation in shareholder meetings, though they do not manage daily operations.

Top Dollar General Shareholders and Investment Firms

Vanguard Group Inc. currently holds the largest stake in Dollar General ownership, with approximately 12.18 percent of the company’s shares. This translates to about 26.82 million shares valued at approximately 2.8 billion dollars. Vanguard, based in Pennsylvania, manages these investments primarily through index funds and mutual accounts that track various market indices.

BlackRock Inc. comes in as the second-largest shareholder, holding approximately 9.8 percent of Dollar General stock. As the world’s biggest asset manager, BlackRock owns around 19.4 million shares worth approximately 2.63 billion dollars. The firm’s substantial Dollar General ownership reflects its confidence in the discount retail sector and the company’s long-term growth prospects.

State Street Corporation represents another significant institutional investor in Dollar General ownership structure, holding approximately 4.55 percent of shares. Other notable institutional shareholders include Morgan Stanley, Capital World Investors, and T. Rowe Price Associates, each maintaining substantial positions that contribute to the overall institutional ownership percentage.

| Investment Firm | Ownership Percentage | Share Count | Estimated Value |

|---|---|---|---|

| Vanguard Group Inc. | 12.18% | 26.82 million | $2.8 billion |

| BlackRock Inc. | 9.8% | 19.4 million | $2.63 billion |

| State Street Corporation | 4.55% | 10.0 million | $1.05 billion |

| Other Institutional Investors | 66.82% | 147 million | $15.4 billion |

Dollar General Leadership and Management Structure

Who Is the CEO of Dollar General Corporation

Todd Vasos serves as the Chief Executive Officer of Dollar General, having returned to this leadership position in October 2023. His journey with the company demonstrates deep familiarity with Dollar General operations and strategy. Vasos initially served as CEO from June 2015 to November 2022, during which time he led the company through remarkable transformation and growth.

Under Vasos’ initial leadership tenure, Dollar General expanded its store base by approximately 7,000 locations, added nearly 60,000 net new jobs, and increased annual sales revenue by more than 80 percent. The company also more than doubled its market capitalization to approximately 58 billion dollars during this period, demonstrating the effectiveness of his strategic vision.

After briefly retiring in April 2023, Vasos returned to lead Dollar General through what the board described as a pivotal time for the company. His leadership focuses on returning to operational excellence while maintaining the fundamental principles that have driven Dollar General success for over 85 years. The board’s decision to bring back Vasos reflects confidence in his proven track record and his ability to navigate the evolving retail landscape.

Dollar General Board of Directors and Corporate Governance

The Dollar General board of directors comprises independent directors and individuals with extensive business experience. Michael Calbert serves as Chairman, leading a board that includes directors such as Timothy McGuire and Debra Sandler, who bring diverse backgrounds to corporate governance. This structure reflects a commitment to strong corporate governance, with members chosen for their expertise rather than direct representation of major shareholders.

Historical Journey: From Family Business to Public Corporation

Understanding who owns Dollar General today requires examining the company’s evolution from a family enterprise to a publicly traded corporation. James Luther Turner and his son Cal Turner founded the business in 1939 in Scottsville, Kentucky, initially operating under the name J.L. Turner and Son.

The Turner family built the business on a simple yet powerful concept: providing affordable merchandise to small-town America. By 1955, they rebranded to Dollar General, adopting a strategy that focused on selling items for one dollar or less. This approach resonated with consumers and fueled rapid expansion throughout the southeastern United States.

Dollar General went public in 1968, marking the first major shift in ownership structure. This transition opened ownership to a broader investor base and provided capital for expansion. However, the ownership journey did not end there. In 2007, private equity firm Kohlberg Kravis Roberts, along with GS Capital Partners and Citigroup Private Equity, acquired Dollar General for 6.9 billion dollars, taking the company private.

The private equity ownership period lasted only two years. In 2009, Dollar General returned to public markets through an initial public offering, establishing the current ownership structure where institutional and retail investors can purchase shares. The Turner family, while no longer maintaining controlling interest or management roles, left an enduring legacy in American discount retail that continues through Dollar Tree and other discount retailers who have followed similar business models.

Dollar General Financial Performance and Market Valuation

Revenue and Earnings Analysis for Dollar General Stock

Dollar General generated 40.612 billion dollars in revenue during fiscal year 2024, which ended January 31, 2025. This represents a 5.0 percent increase from the previous fiscal year, demonstrating continued growth despite challenging macroeconomic conditions. The revenue growth reflects the company’s ability to serve core customers who increasingly rely on Dollar General for affordable everyday essentials.

However, profitability faced headwinds during this period. Net income decreased to approximately 1.13 billion dollars in fiscal 2024, impacted by various factors including store portfolio optimization charges and ongoing investments in the business. The company recorded charges of 232 million dollars in the fourth quarter related to store closures and impairment of pOpshelf locations, demonstrating management’s willingness to make difficult decisions to strengthen the foundation of the business.

Dollar General Market Cap and Stock Valuation

As of September 2025, Dollar General market capitalization sits at approximately 22.93 billion dollars. This valuation reflects current stock performance and investor confidence in the company’s strategic direction. The market cap has experienced fluctuations over the past year, decreasing by approximately 15.8 percent from previous highs as the company navigates operational challenges and invests in long-term growth initiatives.

The stock trades on the New York Stock Exchange under the ticker DG, with approximately 220 million shares outstanding. Current trading prices reflect investor assessment of Dollar General growth prospects, competitive positioning in discount retail, and ability to serve core customers in an uncertain economic environment. Similar discount retailers like Costco Wholesale have seen their own market dynamics as the retail sector continues to evolve.

Dollar General Store Growth and Expansion Strategy

Dollar General operates 20,582 stores as of May 2025, including Dollar General locations, DG Market stores, DGX urban format stores, pOpshelf concept stores, and Mi Súper Dollar General stores in Mexico. This extensive store network makes Dollar General the largest discount retailer in the United States by store count, with presence in 48 states and Mexico.

For fiscal 2025, management outlined plans to open approximately 575 new stores while also executing approximately 4,250 store remodels. This includes 2,000 full remodels and 2,250 stores updated through Project Elevate, an initiative targeting mature stores that are not yet part of the full remodel pipeline. The company also plans to relocate approximately 45 stores to optimize its retail footprint.

The expansion strategy reflects Dollar General commitment to serving customers in rural and suburban communities where access to affordable retail options may be limited. However, the company also announced plans to close 96 Dollar General stores and 45 pOpshelf stores during 2025 as part of ongoing portfolio optimization. These closures represent less than one percent of the overall store base but demonstrate management’s focus on strengthening the foundation of the business.

Dollar General Private Label Brands and Subsidiaries

Dollar General ownership extends beyond just the retail stores to encompass a portfolio of private label brands that generate significant revenue. Clover Valley leads the private brand lineup with 2.3 billion dollars in annual sales, offering customers affordable alternatives to national brands across various product categories.

Other popular Dollar General private brands include DG Health for health and wellness products, TrueLiving for home goods, and Believe Beauty for cosmetics and personal care items. These house brands allow Dollar General to offer customers quality products at lower prices while maintaining higher profit margins compared to national brand merchandise.

The Dolgencorp subsidiary handles manufacturing and distribution operations for Dollar General. Additionally, Dollar General Global Sourcing manages international procurement from a facility in Hong Kong, enabling the company to source products efficiently from global suppliers while maintaining quality standards.

Comparing Dollar General Ownership to Competitor Retailers

Understanding who owns Dollar General becomes more meaningful when compared to ownership structures of competing discount retailers. Dollar Tree, which merged with Family Dollar in 2015, maintains its own institutional ownership profile with similar concentration among major asset managers. This merger created a formidable competitor in the dollar store sector, though the two companies remain independently owned and operated.

Walmart, while operating in a different retail segment, shares some similarities in institutional ownership concentration. However, the Walton family maintains significant ownership and control of Walmart, representing a key difference from Dollar General where no family or individual holds majority control. This distinction affects corporate governance and strategic decision-making processes between the two retailers.

Target Corporation presents another comparison point, with institutional investors holding the majority of shares but with different strategic positioning in the retail market. These ownership comparisons illuminate how different retail business models attract various types of investors and how ownership structures can influence company strategy and performance.

Frequently Asked Questions About Dollar General Ownership

Does Walmart own Dollar General stock or control the company?

+No, Walmart does not own Dollar General. These companies operate as completely independent and competing discount retailers. Dollar General is a publicly traded corporation with institutional investors like Vanguard and BlackRock holding the largest ownership stakes. Walmart competes directly with Dollar General in many markets, offering different retail formats but targeting similar value-conscious consumers.

Who owns the majority of Dollar General shares?

+Institutional investors collectively own approximately 93.35 percent of Dollar General shares. Vanguard Group holds the largest individual stake at approximately 12.18 percent, followed by BlackRock at 9.8 percent and State Street at 4.55 percent. No single entity owns a majority of shares, meaning ownership is distributed among many institutional and retail investors.

Is Dollar General owned by Family Dollar or Dollar Tree?

+No, Dollar General is not owned by Family Dollar or Dollar Tree. While Dollar General attempted to acquire Family Dollar in 2014, that deal did not succeed. Instead, Dollar Tree completed a merger with Family Dollar in 2015. All three companies now operate as separate publicly traded corporations with different ownership structures, though they compete in the discount retail sector.

Is the Turner family still involved in Dollar General ownership?

+The founding Turner family no longer maintains a controlling interest or active management roles in Dollar General. While the Turners built the company from its founding in 1939 through decades of growth, the transition to public ownership in 1968 and subsequent changes in ownership structure have diluted family control. The Turner legacy continues through the company’s commitment to serving value-conscious consumers in small-town America.

How can individual investors own Dollar General stock?

+Individual investors can purchase Dollar General stock through any brokerage account that provides access to New York Stock Exchange listed securities. The stock trades under the ticker symbol DG. Investors can buy shares through traditional brokerages, online trading platforms, or retirement accounts. As a publicly traded company, Dollar General stock ownership is available to any qualified investor who wants to participate in the company’s future performance.

What role does Todd Vasos play in Dollar General ownership and leadership?

+Todd Vasos serves as CEO and a member of the board of directors but owns only a small percentage of Dollar General stock personally. His role involves managing operations and implementing strategy rather than maintaining significant ownership control. Vasos owns approximately 0.062 percent of company shares through compensation and previous stock purchases. His influence comes from his position as chief executive rather than from ownership concentration.

Why did private equity firms sell their Dollar General ownership stake?

+Kohlberg Kravis Roberts and partners returned Dollar General to public markets in 2009 after a successful two-year private ownership period. Private equity firms typically acquire companies, implement operational improvements, and then sell or take companies public to realize returns for their investors. The Dollar General IPO allowed KKR and co-investors to profit from their investment while providing the company with access to public capital markets for continued growth and expansion.

Citations and Sources

- WallStreetZen. (2025). “Dollar General Stock Ownership – Who Owns Dollar General in 2025?” Retrieved from https://www.wallstreetzen.com/stocks/us/nyse/dg/ownership

- Dollar General Corporation. (2025). “Dollar General Corporation Reports Fourth Quarter and Fiscal Year 2024 Results.” Investor Relations. Retrieved from https://investor.dollargeneral.com

- MacroTrends. (2025). “Dollar General Market Cap 2010-2025.” Retrieved from https://macrotrends.net/stocks/charts/DG/dollar-general/market-cap

- Dollar General Newsroom. (2025). “Chief Executive Officer Bio – Todd Vasos.” Retrieved from https://newscenter.dollargeneral.com/chief-executive-officer-bio

- SEC Filing. (2025). “Dollar General Corporation Form 10-K.” U.S. Securities and Exchange Commission. Retrieved from https://www.sec.gov/Archives/edgar/data/29534/