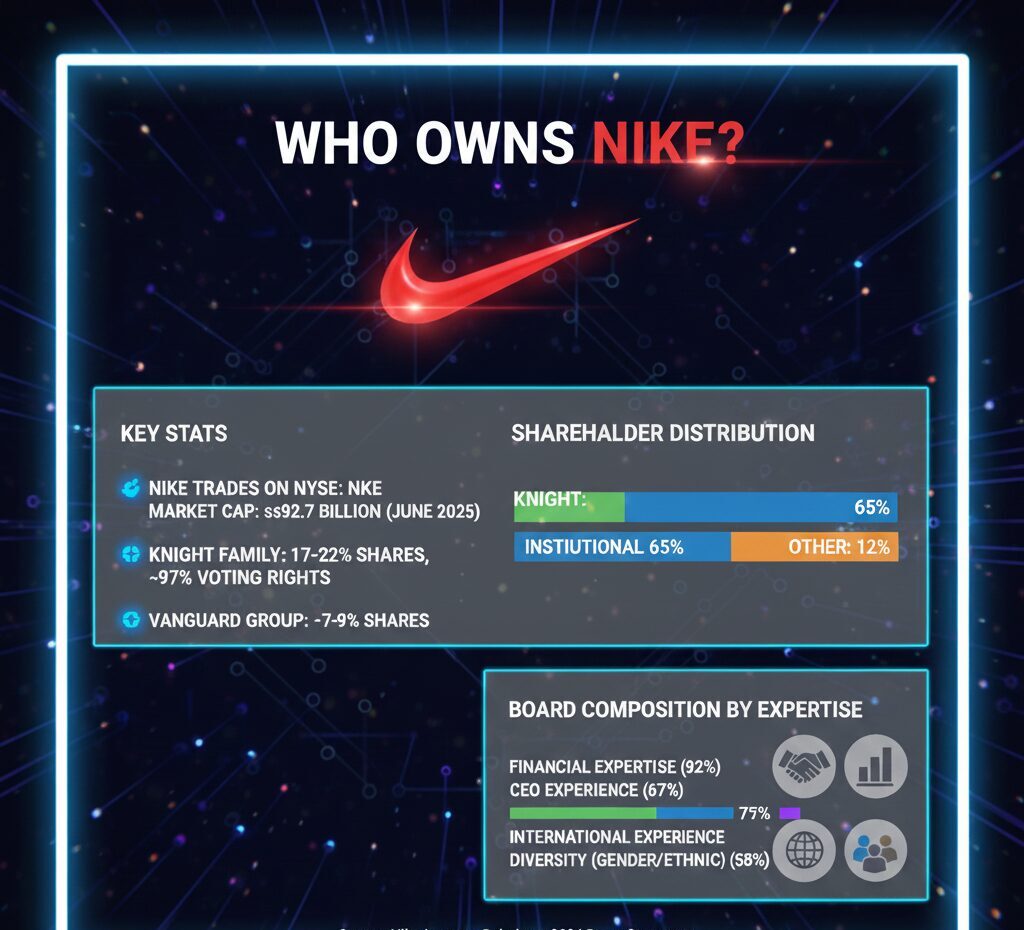

Key Stats

- Nike trades on NYSE under ticker symbol NKE with a market capitalization of approximately $92.7 billion as of June 2025

- Phil Knight family controls roughly 97% of Class A voting rights despite owning only 17-22% of total shares

- Vanguard Group leads institutional ownership with approximately 7-9% of Nike shares

- Revenue for twelve months ending February 2025 reached $47.82 billion, down 7.3% year-over-year

Nike is owned by millions of public shareholders who trade the company’s stock on the New York Stock Exchange, but the Knight family maintains dominant control through a dual-class share structure. While institutional investors like Vanguard and BlackRock hold substantial stakes, Phil Knight and his family control approximately 97% of Class A voting rights, giving them effective authority over board appointments and strategic decisions.

The sportswear giant has evolved from a small shoe distributor to a global powerhouse with operations spanning more than 190 countries. Under the leadership of CEO Elliott Hill, who returned to Nike in October 2024, the company continues to navigate changing market conditions while maintaining its position as the world’s leading athletic footwear and apparel brand. The company’s ownership structure reflects a careful balance between public market participation and founder-led vision.

Nike’s brands include the flagship Nike label, Jordan Brand, Converse, and TravisMathew. The company operates through direct-to-consumer channels and wholesale partnerships, with digital platforms playing an increasingly important role in customer engagement and sales growth.

Who owns Nike?

Nike operates as a publicly traded corporation with shares available on the New York Stock Exchange under the ticker NKE. The ownership structure features a dual-class share system that separates economic ownership from voting control.

The Knight family, through Swoosh LLC and personal holdings, owns approximately 17-22% of Nike’s total shares. However, their holdings include significant amounts of Class A stock, which carries enhanced voting rights. This structure allows the family to control roughly 97% of Class A votes, providing them with practical authority over board composition and major corporate decisions.

Institutional investors collectively hold around 65% of Nike shares, with the remaining portion distributed among retail and other public investors. Major institutional shareholders include Vanguard Group, BlackRock, and State Street Global Advisors, though their influence is primarily exercised through proxy voting on Class B shares. This ownership model has enabled Nike to maintain long-term strategic focus while accessing public capital markets.

Largest shareholders of Nike

Understanding Nike’s shareholder composition reveals how control and economic interest are distributed across different investor groups. The following sections detail the major stakeholders who influence the company’s direction.

Knight Family Holdings

Phil Knight, Nike’s co-founder, remains the most influential shareholder through both direct ownership and the Swoosh LLC entity he established in 2015. As of 2024, Knight personally owned 23.9 million Class A shares and 32.2 million Class B shares. Swoosh LLC holds an additional 230.75 million Class A shares and an equivalent amount of Class B shares.

Travis Knight, Phil’s son, controls 34.8 million shares of each class through a trust arrangement. Combined, these holdings give the Knight family control over approximately 77.5% of all Class A shares, translating to 97% of Class A voting power. This voting control ensures the family can elect the majority of Nike’s board of directors and influence fundamental strategic decisions.

Vanguard Group

Vanguard Group stands as Nike’s largest institutional shareholder, holding roughly 109 million Class B shares representing 7-9% of the company. As a passive investment firm managing index funds and ETFs, Vanguard’s stake reflects Nike’s position in major market indices. The firm’s substantial holdings influence proxy votes on corporate governance matters, though it lacks the voting control enjoyed by the Knight family.

BlackRock and Other Major Institutions

BlackRock follows Vanguard with approximately 66-89 million shares, representing 5.6-6% ownership. State Street Global Advisors holds about 57 million shares (3.9-4.9%), while Wellington Management and Capital Research & Management each maintain positions of 1.5-3.7% and 1.9-3.5% respectively.

Additional significant institutional holders include Geode Capital Management with 1.6-2.2% and Norway’s sovereign wealth fund Norges Bank Investment Management with 1.0-1.3%. Activist investor William Ackman’s Pershing Square maintains a 1.1-1.5% stake, representing approximately 18.8 million shares.

Nike Shareholder Distribution

Source: Nike Investor Relations

Executive Ownership

Nike’s executive team collectively owns approximately 12.6 million Class B shares, representing about 1.3% of the company. Mark Parker, Executive Chairman, holds roughly 2.74 million shares, while former CEO John Donahoe owns approximately 1.71 million shares. This executive ownership aligns management interests with shareholder value creation and provides meaningful personal stakes in the company’s performance.

History of Nike Co-founders

The Nike story begins in 1964 when University of Oregon track coach Bill Bowerman partnered with his former student Phil Knight to establish Blue Ribbon Sports. The pair started by importing Japanese running shoes from Onitsuka Tiger and selling them from the trunk of Knight’s car at track meets across the Pacific Northwest.

Bill Bowerman’s Innovation Legacy

Bowerman brought his obsession with improving athletic performance to the partnership. His experimental approach to shoe design led to breakthrough innovations, including the waffle sole pattern he created using his wife’s waffle iron. This relentless focus on product innovation established Nike’s DNA and competitive advantage in performance footwear.

Phil Knight’s Business Vision

Knight contributed business acumen and strategic vision to complement Bowerman’s design expertise. After earning his MBA from Stanford, Knight understood the potential for athletic footwear as both performance equipment and lifestyle product. His thesis on Japanese manufacturing quality and cost advantages informed the company’s early sourcing strategy.

By 1971, the partnership had evolved into Nike Inc., named after the Greek goddess of victory. Student designer Carolyn Davidson created the iconic Swoosh logo for $35, cementing the brand identity that would become one of the world’s most recognizable symbols. Bowerman passed away in 1999, but his innovation philosophy continues to guide Nike’s product development approach, much like how Bain & Company maintains its founder’s consulting principles.

Who is on the board of directors for Nike?

Nike’s board of directors consists of 12 members who provide strategic oversight and governance. The board structure reflects the company’s dual-class share system, with directors elected by different shareholder classes.

Executive Leadership Directors

Elliott Hill serves as President, CEO, and board member since October 2024. A Nike veteran who joined in 1988, Hill previously led global marketing and consumer strategy before returning from retirement to lead the company. Mark Parker, who served as CEO from 2006 to 2020, now holds the position of Executive Chairman and guides long-term strategy. Parker also serves as Chairman of the Board at The Walt Disney Company, bringing additional media and entertainment industry perspective.

Travis Knight, son of co-founder Phil Knight, represents the Knight family interests on the board. As CEO of animation studio LAIKA, he brings media and entertainment expertise while maintaining alignment between the board and the family’s Class A shareholdings.

Technology and Digital Expertise

Timothy Cook, CEO of Apple, serves as Lead Independent Director and chairs the Compensation Committee. His technology background and experience scaling global operations provide valuable insights for Nike’s digital transformation efforts. The board’s tech expertise extends through other members with digital and e-commerce backgrounds, similar to leadership structures at Best Buy and other major retailers.

Financial and Operational Directors

Robert Swan, Operating Partner at Andreessen Horowitz and former Intel CEO, chairs the Audit & Finance Committee. Maria Henry, former CFO of Kimberly-Clark, joined the board in 2023, bringing extensive financial and operational experience from leading global consumer brands. Peter Henry, Senior Fellow at Stanford’s Hoover Institution and former Dean of NYU’s Stern School of Business, contributes financial expertise and academic perspective.

Retail and Consumer Sector Leaders

Michelle Peluso, EVP and Chief Customer and Experience Officer at CVS Health, chairs the Corporate Responsibility, Sustainability & Governance Committee. Her background includes leadership roles at IBM, Gilt Groupe, and Citigroup, providing deep e-commerce and customer experience insights.

Thasunda Duckett, CEO of TIAA, brings financial services expertise and understanding of consumer markets. Her previous role as CEO of Chase Consumer Banking at JPMorgan Chase offers perspective on customer engagement and brand loyalty, similar to challenges faced by companies like Foot Locker in the retail footwear space.

Diversity and Media Perspectives

Mónica Gil, Chief Administrative and Marketing Officer at NBCUniversal Telemundo Enterprises, provides media and multicultural marketing expertise. Her experience in communications and diverse market segments helps Nike navigate global consumer trends.

Cathleen Benko, former Vice Chairman of Deloitte, contributes technology sector knowledge and talent management experience from her nearly 30-year career in professional services.

Investment and Governance Expertise

John Rogers Jr., Chairman and Co-CEO of Ariel Investments, brings investment management perspective and serves on the Corporate Responsibility, Sustainability & Governance Committee. He previously served on the board of McDonald’s Corporation from 2003 to 2023, providing extensive governance experience from another major global consumer brand. His background in asset management and board service at The New York Times Company provides additional governance insights.

The board recently nominated Jørgen Vig Knudstorp, former CEO of LEGO Group and current Deputy Chair of the LEGO Foundation, for election at the 2025 annual meeting. Knudstorp also serves as lead independent director of Starbucks, bringing valuable consumer brand experience. His brand management expertise would further strengthen the board’s retail capabilities, similar to the strategic oversight seen at L Brands and other major consumer companies.

Board Composition by Expertise

Data from Nike 2024 Proxy Statement

FAQs

Who is the majority owner of Nike?

The Knight family is the majority voting power holder, controlling approximately 97% of Class A voting rights through Swoosh LLC and personal holdings, despite owning only 17-22% of total shares.

Is Nike a publicly traded company?

Yes, Nike trades publicly on the New York Stock Exchange under ticker symbol NKE. The company went public in 1980 and maintains a dual-class share structure with Class A and Class B stock.

What percentage of Nike does Phil Knight own?

Phil Knight and his family own approximately 17-22% of Nike’s total shares but control roughly 97% of Class A voting rights, giving them effective control over board elections and major decisions.

Who are Nike’s largest institutional shareholders?

Vanguard Group is the largest institutional shareholder with 7-9% ownership, followed by BlackRock with 5.6-6%, State Street with 3.9-4.9%, and Wellington Management with 1.5-3.7% of shares.

Who is the current CEO of Nike?

Elliott Hill became President and CEO in October 2024. A Nike veteran since 1988, Hill previously served as President of Consumer and Marketplace before his return from retirement.